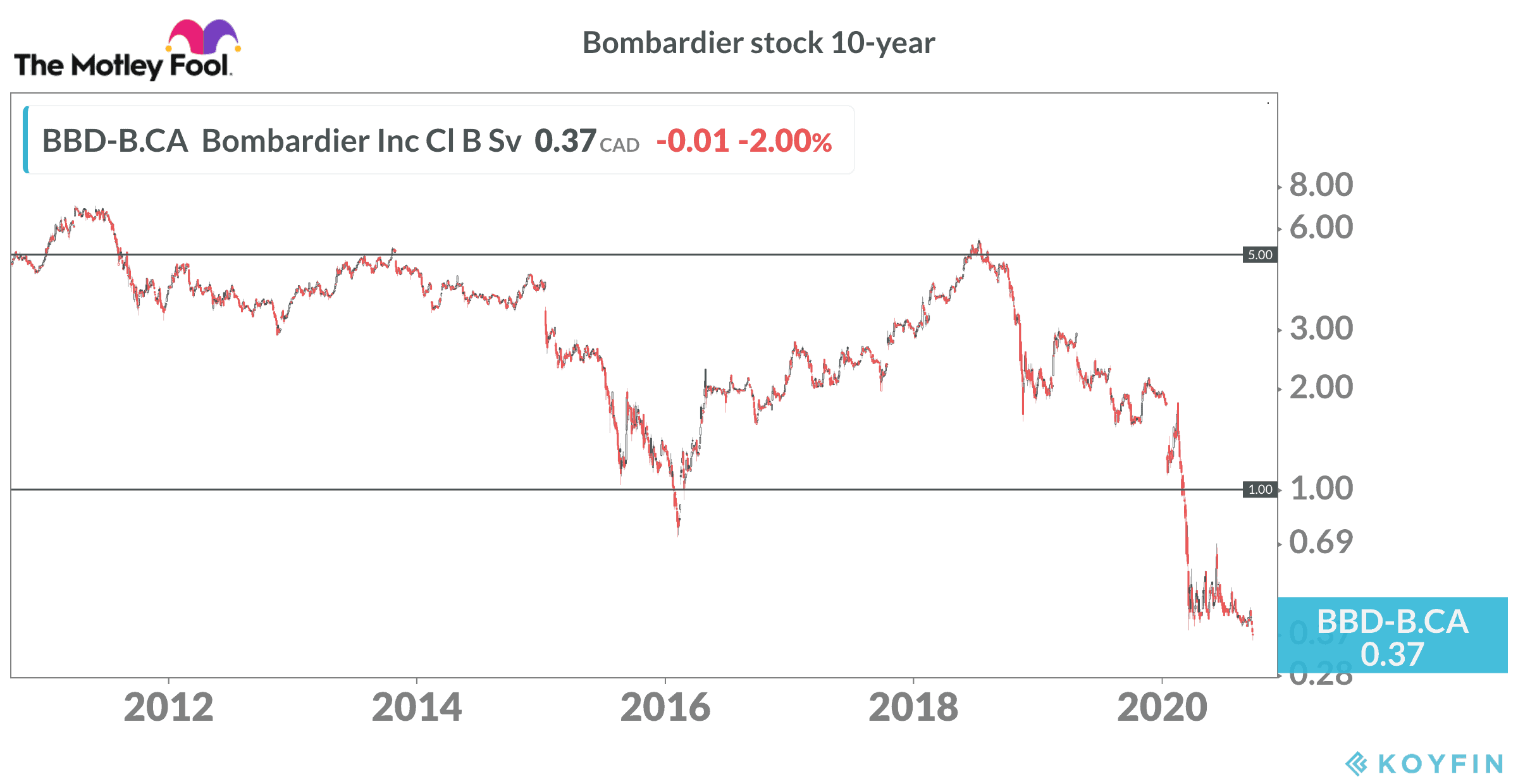

The share price of Bombardier (TSX:BBD.B) continues to hit new lows. Long-term holders of Bombardier stock face massive losses, and pundits wonder if the stock might actually disappear.

Bombardier stock crash

Aside from a few short periods of investor optimism fueled by enthusiastic turnaround predictions, Bombardier stock has been a capital killer for investors.

The stock traded above $20 per share 20 years ago. Since then, the decline indicates how tough it is to compete in the global commercial aircraft industry without being a giant. The financial crisis and now the pandemic made the situation worse, although much of the pain can be attributed to operational challenges in both the aerospace and rail businesses.

At the time of writing, Bombardier stock trades at just $0.37 per share.

CSeries impact on Bombardier stock

Analysts attribute most of trouble in the past decade to the CSeries jet program. Bombardier ambitiously designed a new fuel-efficient series of jets to compete in the mid-range segment of the commercial jet market. The planes actually turned out to be a great product, but development and manufacturing delays caused the program to run a number of years and several billion dollars over budget.

Early buyers of the jets became frustrated. Potential new buyers decided to stay on the sidelines.

It’s too bad, because Bombardier had a great window of opportunity to win orders when oil traded around US$100 per barrel. Once oil prices tanked, the price for jet fuel came down enough to erode much of the benefits derived from buying the CSeries instead of cheaper planes.

Debt piled up, and Bombardier needed to find buyers quickly to avoid a possible bankruptcy. By early 2016, Bombardier stock traded below $1 per share. The board shelved the dividend and brought in new management. A decision to sell CSeries jets at heavily discounted prices helped stabilize the situation, but a deal with Delta Air Lines ran into trouble with the U.S. government due to claims Bombardier used aid from Quebec to sell the planes at a significant loss. The implementation of steep tariffs on CSeries jets sold to U.S. customers put the Delta deal in jeopardy.

Bombardier sold a majority stake in the CSeries to Airbus to sidestep the tariffs, which the U.S. then dropped. The European giant is making the planes at its U.S. facilities. Airbus recently took full control of the remaining part of the CSeries, now branded A220.

Train woes

Bombardier’s rail group had its own issues with delivery delays and manufacturing problems.

The very public spat with the Toronto Transit Commission (TTC) over delayed deliveries on a large streetcar order might have contributed to the loss of several key bids. In recent years, Bombardier missed out on light rail contracts in Boston, Chicago and Montreal. Canada’s Via Rail even gave a $1 billion contract to a competitor.

Bombardier just announced definitive plans to sell its rail group to Alstom. The deal should provide net proceeds of roughly US$4 billion to Bombardier.

Will Bombardier stock survive?

Bombardier carries roughly US$9 billion in debt. A successful completion of the rail group sale next year would provide essential capital to help pay back debt coming due in the next two years. Bombardier already sold off all of the commercial airline divisions and will be left as a pure-play maker of business jets.

The company’s prospects looked better before the arrival of the pandemic. Now, it is uncertain if the private jet sector will be strong enough to get Bombardier through the storm.

Contrarian investors should be careful betting on a new rally. The company might pull off a turnaround, but there is also a risk it could disappear.

If you have some cash to invest on a contrarian stock, I would look for other opportunities today.