Since its March 2020 lows, Kinaxis (TSX:KXS) stock has outperformed significantly. This has been great for shareholders. But for those investors who feel like they have missed the boat, don’t fret. A market crash is coming. With it, we will have the opportunity to buy Kinaxis stock at much lower prices.

So, why would we even want to buy Kinaxis stock when the market crashes? Here are two reasons.

Double-digit revenue growth over the long term

Kinaxis has been delivering exceptional results since its 2014 IPO. Accordingly, Kinaxis’s stock price has been delivering exceptional returns. Years of strong revenue growth have translated into a 1,290% stock return for Kinaxis stock.

And this $4.9 billion tech giant is not done yet. This Ottawa-based developer of cloud-based supply chain management solutions continues to gain market acceptance and market share. Real-time supply chain management is here to stay, and Kinaxis is a proven leader.

The strengths of Kinaxis’s business model are multi-faceted. Kinaxis focuses on manufacturers with over $1 billion in revenue across seven vertical markets. These markets include stable industries with strong long-term growth profiles. Examples of these industries are life sciences, high-tech and electronics, and consumer products industries. This diversification and focus on large established companies provides Kinaxis with a level of stability.

Kinaxis stock has big downside in the next market crash and big upside afterwards

Kinaxis has achieved a five-year compound annual revenue growth rate of 16%. This was done while delivering free cash flow and maintaining a strong balance sheet. So, it makes sense that Kinaxis stock has done well. But in 2020, the stock seems to have gotten ahead of itself. Kinaxis stock’s valuation needs to be brought down in the next market crash before I would recommend buying

With Kinaxis stock, there is certainly room to head significantly lower. By this I mean that the shares are looking quite lofty. And the downside risk is big. Kinaxis stock currently trades at ridiculously high multiples. Its earnings multiple is 161 times this year’s earnings, at a time when earnings have hit a speedbump. But even if we go forward to the 2022 consensus estimate, Kinaxis’S P/E multiple is still a lofty 81 times.

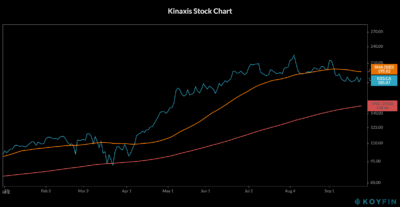

Let’s move on to the stock’s performance in 2020. In the chart below, we can see the volatility that exists.

Kinaxis stock fell 22% in March to its 2020 low of $92.33. The stock subsequently rose 141% in five short months to $222.50. That’s a spectacular return, for sure. Today, six months later, Kinaxis stock is 100% above March lows at $183.70.

But while the stock has come down a bit, it’s still not the right time to buy. The stock has already crossed through its 50-day moving average (the orange line), which is good for those of us looking to buy. The 50-day moving average is starting to approach the 200-day moving average. If it crosses to the downside, this would be a technical buy signal.

We know the opportunity. Now we just have to become comfortable with the price we will pay for this opportunity.

Foolish bottom line

Kinaxis stock is a tech stock with a bright future. Supply chain management is moving onto the cloud with the help of Kinaxis’s software. The increasing digitization of this and other functions is improving company performance and efficiency. It is making Kinaxis and Kinaxis shareholders rich in the process.

For those investors who would like to get in on this outperformer, wait for the next market crash. You can then scoop it up at much lower valuations. Patience is the key.