Market crashes can bring mixed feelings for investors. On the one hand, it’s a great opportunity to buy new TSX stocks while they’re cheap or that lower your average cost of existing investments.

On the other hand, though, it can be a dreadful feeling to watch tons of value slip away, as stocks are sold off rapidly.

The key for investors, however, is to remain disciplined and hold your investments, despite what your emotions may tell you. This will leave you better off down the road when the market inevitably recovers.

Unfortunately, life isn’t always so straightforward. And although you may know you shouldn’t be selling stocks in a market crash, often there can be extenuating circumstances that force you to need the capital.

If that’s the case, you’re better off selling your highest risk stocks first. But one thing you definitely won’t want to do is sell these two stocks.

Top consumer staple stock on the TSX

Selling your highest-risk stocks first is important, since they will likely be the most vulnerable. Furthermore, they probably won’t be your best investment if there is so much risk around the stock.

This will allow investors to raise any necessary funds while continuing to hold their highest-quality companies, like Alimentation Couche-Tard (TSX:ATD.B).

Alimentation Couche-Tard is not only a great long-term investment, but the company is actually a consumer staple — one of the best industries to be invested in during a market crash and recession.

Couche-Tard operates convenience stores and gas stations all around the world. These are great businesses; however, they were impacted by coronavirus shutdowns.

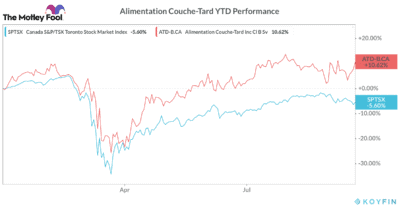

Usually, most consumer staples offer investors great defence but trail the market when it’s growing. Not Alimentation Couche-Tard, though.

The consumer staple stock has been one of the top growth companies on the TSX and has consistently rewarded long-term investors. Since 2010, the stock has gained more than 1,350%. And even this year, through a pandemic that’s caused major shutdowns, the stock is still outperforming the market.

A lot of the outperformance this year is because management has proven to be superior. Whether through acquisition or organic growth, the company continues to find new ways to increase profitability and cash flow.

So, despite this negatively impacting the industry at first, I would expect a company like Couche-Tard to turn this into a positive and look for opportunities to increase its dominance.

The company is well positioned and well capitalized. I would expect it to look to make some significant acquisitions over the short term, especially if it can find some distressed businesses and the price is right.

TSX gold stocks

Besides high-quality stocks like Couche-Tard, you’ll also want to make sure you hold your gold stocks. There isn’t one specific gold stock to list over others.

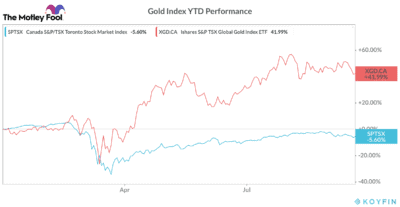

It’s just crucial investors understand that in these uncertain times, with interest rates next to nothing, gold will be one of the top performers.

So, you’ll definitely want to make sure that you don’t sell your gold stocks during a market crash, right before they break out again to the upside.

As you can see back in the first market crash, the iShares S&P/TSX Global Gold Index ETF, which tracks a basket of TSX gold stocks, initially declined with the market. However, soon after, it had a major recovery and has now significantly outperformed the TSX.

So, if you don’t have any gold stocks, now is the time to buy. If you already own TSX gold stocks, make sure you don’t sell them in a market crash, no matter what.

Bottom line

It’s never ideal to sell stocks anytime but especially as the market is selling off. Sometimes, however, these things are unavoidable. So, make sure if you are in that unfortunate position, you sell your highest-risk stocks first.

That way, you can continue to hold your top TSX stocks that will offer you better support to weather the market crash.