The year 2020 has been one to remember for stock markets. Investors have learned plenty of lessons, and we continue to expect the unexpected. Developments are consistently surprising investors, and often whatever you think will happen results in the complete opposite.

Nobody expected a stock market crash caused by a pandemic coming into 2020. Furthermore, hardly anyone would have expected a rapid rebound. Now, less than eight months after the pandemic began, several stocks are back at all-time highs.

Heading into election season, once again, uncertainty is as high as can be, and with many possibilities for stocks for the rest of the year, here is the top risk for a market crash before 2021.

Market crash risks today

When we think of the fall, the number one risk on investor’s minds is another shutdown. The economy is already vulnerable, and many health and science experts expect a second wave to materialize with the flu season.

While there is a strong possibility of a second wave, if things don’t get too dire, I’m not sure it would cause the same level panic it did back in February and March.

At that time, there was a lot more uncertainty about the pandemic. Furthermore, businesses have had a long time to figure out how to operate under new guidelines, and investors have had the chance to see which businesses have been able to weather the storm.

Therefore, a second wave of coronavirus as well as more shutdowns are things to watch, I don’t believe they are the most significant risks of another stock market crash at the moment.

U.S election

In my opinion, the uncertainty around the U.S. election is what it will be.

Traditionally there is always uncertainty leading up to the election. This year, however, it’s much different. With the stakes so high and the country in the middle of a major pandemic, the election will look like something we have never seen before.

People have already started to vote by mail and in person, as the U.S. tries its best to get every citizen to vote in the safest way.

The problem is, many political and historical experts believe that due to the mass amounts of mail-in ballots and the close race in several swing states, it’s highly likely we could go days before getting an answer as to who won.

This uncertainty, coupled with all the other major issues and risks in markets, could send stocks tumbling. So it’s definitely something to pay attention to and watch out for.

Stock to buy for a market crash

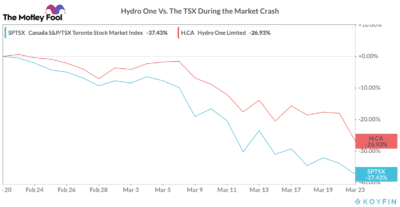

If you are concerned your portfolio may be at risk in another market crash, consider a low volatility stock such as Hydro One (TSX:H).

Hydro One is a high-quality utility stock that’s perfect for investors looking for a low-risk investment.

Not only will the stock fall less in a market crash just as it did back in March. In addition, though, it will likely be one of the first stocks to rally back as its business is only minimally impacted by recessions.

That’s what makes it attractive to investors. Hydro One specifically operates electricity transmission and distribution assets. The demand for electricity is highly sticky, meaning it won’t fluctuate much even as the economy weakens.

Furthermore, the utilities industry is highly regulated, helping to reduce even more risks for investors.

This all results in an excellent investment that will hold value better than the market and continue to pay a safe dividend to investors. Today its dividend yields roughly 3.7%.

Bottom line

There are several possibilities for another market crash in 2020. Whether it’s caused by the election or a host of other possibilities, if your portfolio is in need of some defence, I’d consider a low-risk stock like Hydro One.