2020 has been a volatile year for TSX stocks, but those investors who have stayed disciplined and had a plan have no doubt had some excellent performances.

Sometimes the best investments start with only a small investment. It doesn’t take much for investors to gain an initial position. Then, over time, as you own and follow the stock, you’ll learn more about it.

And if you really like the company and believe it’s undervalued, you may even be enticed to buy more. This is often the case, especially as stocks are selling off, just as they did in the market crash earlier this year.

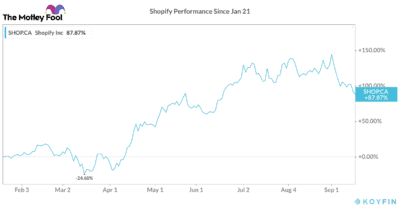

For example, say you bought a stock like Shopify back in January around $600, believing it had long-term growth potential. Then, only a matter of weeks later, you would’ve lost nearly a quarter of your money, as the stock crashed with the rest of the market.

Knowing Shopify’s advantages and what would drive its business, savvy investors would have been buying as the TSX stock got cheaper. This would not only lower your average cost per share but would set you up for even bigger gains when the stock eventually did return to its fair value.

And as we’ve seen with Shopify over the last six months, investors who did this have been rewarded majorly. It’s come down over the last few weeks and is still up 87% from that mid-January price of $600.

Today, many stocks have recovered significantly, so investors looking strictly for value stocks will have to take on significant risk to do so.

A better investment strategy for this environment is buying high-quality TSX stocks you can count on to provide consistent growth in earnings and a dividend.

TSX stock to buy today

One of the top stocks I’d recommend today is BCE (TSX:BCE)(NYSE:BCE).

BCE is the biggest telecom in Canada — a great long-term investment industry. It’s one of the biggest and best stocks in Canada, making it perfect as a core holding.

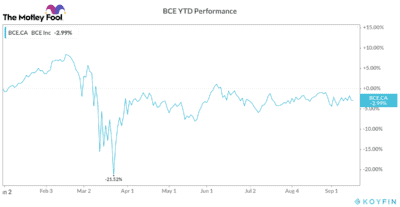

The stock has suffered slightly since the start of the pandemic; however, much of this has to do with short-term impacts on its business.

As you can see, the stock is still down year to date. Investors are concerned that the pandemic is having an effect on BCE’s wireless business. While this is true in the short term, long term, these issues will have very little effect on the company’s performance.

There are many more catalysts for growth, such as the introduction of 5G technology, which will provide investors with growth for years to come.

Not to mention, BCE is an extremely high-quality business. So, expect the company to find a lot of cost savings to minimize the impact of the lost revenue.

That resiliency can also be seen in the chart, as the company had a much less significant fall in the market crash than many TSX stock peers. This lower volatility is what makes BCE a great low-risk investment.

BCE is an ideal buy today for long-term investors, because the stock is slightly undervalued, and can protect your capital. It also pays a dividend that’s increased often and currently yields 5.95%.

Bottom line

Even with as little as $500, investors can take an initial position in BCE. It’s one of the top long-term stocks on the TSX, offering investors consistent long-term growth and an attractive dividend.