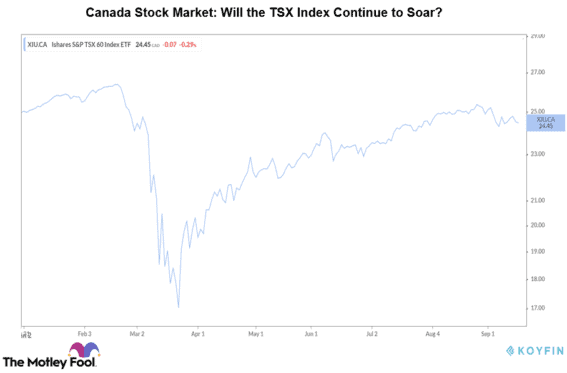

While the TSX Index has soared more than 50% since its March lows, it has underperformed the S&P 500 in the subsequent rally. Stock markets turned lower in the last few weeks as top-rallying tech stocks showed signs of exhaustion recently. Interestingly, the divergence is still concerning given the ailing economy and rallying stock markets amid the pandemic. Is the recent weakness a hint of a crash? Is there a bubble about to burst?

Canadian stock market

The stock markets have rallied in the last few months, as there has been a slow but stable improvement on the economic front. Though the GDP shrank in the second quarter, the damage was relatively lower than some experts anticipated. Corporate earnings growth in the second half of the year also paints a rosy picture, which might continue to push the TSX Index higher.

Importantly, the tech sector’s weakness, both in Canada and south of the border, seems interim. Tech giants like Shopify and Apple have had a bigger contribution to lifting the respective indexes. Inflated valuation is mainly behind their recent weakness, and it does not change their fundamentals. Investors will likely turn to those high-growth names, lifting the broader markets again.

Investors should note that if the economic data were to weigh on stocks, we would have seen another crash so far. However, stock markets are leading indicators of the economy, and they run a couple of quarters ahead.

A weaker economy and soaring stocks

Interestingly, many parts of the global economy have seen higher consumer spending, despite record-low employment levels. That’s because the government stimulus like direct benefit transfers has patched the pandemic wounds to some extent. Even if many federal support programs are coming to an end, those will likely be renewed or extended.

TSX Index has a larger exposure to the financial and energy sectors against tech. Energy might remain weak amid the weakness in crude oil prices. However, Canadian energy companies have relatively lower breakeven prices compared to their peers in the U.S., making them more resilient in the current situation.

Top Canadian bank stocks have also been trading subdued in the last few months amid the economic uncertainty. How banks’ earnings play out after the moratorium ends will be interesting to see.

Interestingly, despite the rally, Canadian stock markets do not look significantly overvalued at the moment. TSX stocks at large have a forward price-to-earnings ratio well below 20, notably lower than the S&P 500. This suggests that the TSX Index is not in a bubble, and we might not see another crash. However, some segments of the markets look overvalued, which has led to an ongoing correction.

The Foolish takeaway

That does not mean that the markets will continue to grow. With a lack of positive indicators and a struggling economy, the TSX Index might have limited upside from here. While I don’t expect a crash anytime soon, I also don’t see stocks moving significantly higher.

For long-term investors, higher exposure to defensive, dividend-paying stocks could turn effective. A big, one-time investment could prove detrimental at this time and will likely incur a huge opportunity cost.