Teck Resources (TSX:TECK.B)(NYSE:TECK.B) stock just surged more than 12% to its highest share price in more than six months.

Teck Resources stock price

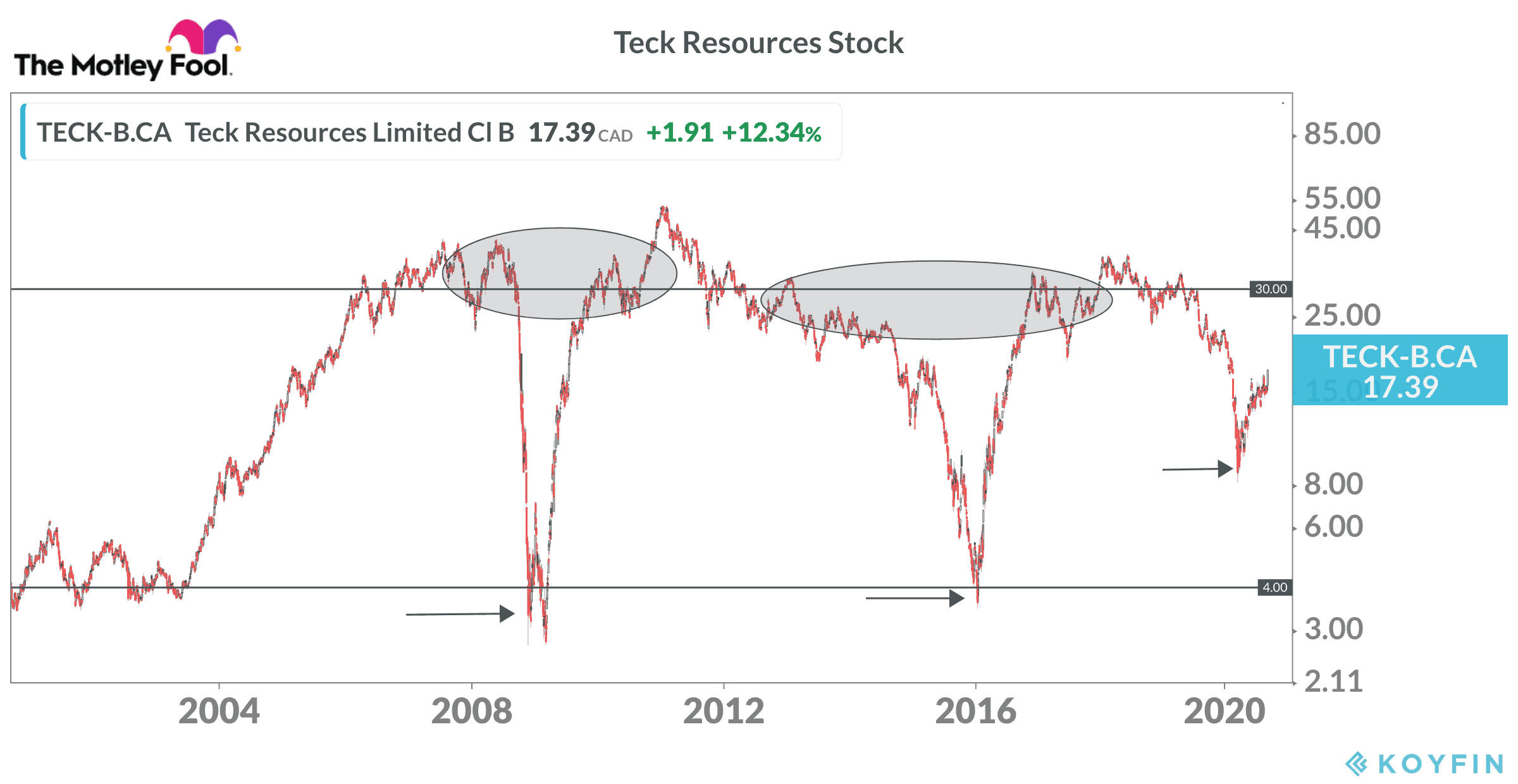

At the time of writing, Teck Resources stock trades near $17.50 per share. That’s back to where the shares traded before the start of the pandemic market crash last February.

The rebound shouldn’t be a surprise to long-time followers of Teck stock, and more upside is likely on the way.

Why?

Teck has a history of volatile moves. Investors who buy Teck Resources stock at the right time can enjoy massive gains on the rebound. Those who buy right near the end of the party often lose their shirts.

Teck is a commodity producer with the core divisions being metallurgical (steel-making) coal, copper, and zinc. Teck is also a part owner of the Fort Hills oil sands facility. When economic times are bad, demand for steel, base metals, and oil falters. This puts pressure on prices and hits Teck’s margins.

As we saw after the financial crisis and will likely see again in the wake of the pandemic, governments ramp up fiscal stimulus efforts to boost economic growth. This includes infrastructure projects that use lots of steel and base metals. As the economy recovers, fuel demand also increases.

Why is Teck Resources stock moving higher now?

Copper and zinc prices enjoyed strong rallies off the March lows, and the momentum should continue through 2021. Copper trades near US$3 per pound. This is a two-year high and significantly above the US$2 low it hit earlier this year. Zinc is above US$1.10 per pound after dipping below US$0.85 at the bottom of the market crash.

Steel production should start to ramp up as new infrastructure projects get under way around the world. This would support higher prices for steel-making coal.

The recent surge in Teck’s stock price might actually be connected to the oil investments. Teck just announced plans to restart production at the second Fort Hills train. This will increase production to roughly 120,000 barrels per day by the end of the year.

Teck’s share is about 21.3% on the project. The announcement also included a boost to the bottom end of production guidance for the year at Fort Hills and unit operating costs for the facility dropped by $2 per barrel.

Teck outlook

Teck management came under pressure in the past year. Investors want the company to get out of the oil business. With the economy starting to get back on track and oil prices heading higher, Teck might decide to sell its stake in Fort Hills to one of the other partners. Suncor Energy would be the most likely buyer.

If that happens at a favourable price, Teck’s share price could see another upswing.

Should you buy Teck Resources stock today?

The 2020 low near $9 should be the bottom in the current cycle. The last three times Teck Resources tanked, it has rallied from lows near $4 per share to above $50 twice and above $38 at the peak in early 2018.

The company has a much stronger balance sheet today than it did in previous meltdowns, so the downside risk should be small at this point, and there is significant upside opportunity. You’ll also pick up a small dividend.

A rally back above $30 by the end of 2021 wouldn’t be a surprise, and $40 could be in reach on a strong rebound in demand for steel and the base metals.

If you have some cash on the sidelines for a TFSA or RRSP investment, Teck deserves to be on your radar.