Buy low, sell high.

It’s the first thing you hear when you start investing. Heck, it’s the first thing you hear even if you aren’t into investing. But it’s a whole lot trickier than it seems.

If you’re buying low and planning to sell high, you’d better be sure you can stake on the risks. And that’s what it comes down to if you want to be a millionaire in only a short time. You could also stand to lose a lot. Here at the Motley Fool, while no stock comes without risk, we do recommend the surest course to success: buy and hold.

If you’re buying a fairly strong stock, it’s less likely that it’ll crash and burn in the years to come. While this isn’t a sure thing, it’s definitely a good strategy, to say the least. But if you’re able to combine both buying low with holding, then selling high decades from now, that is exactly the best strategy you can take.

So, what should you buy?

Air Canada

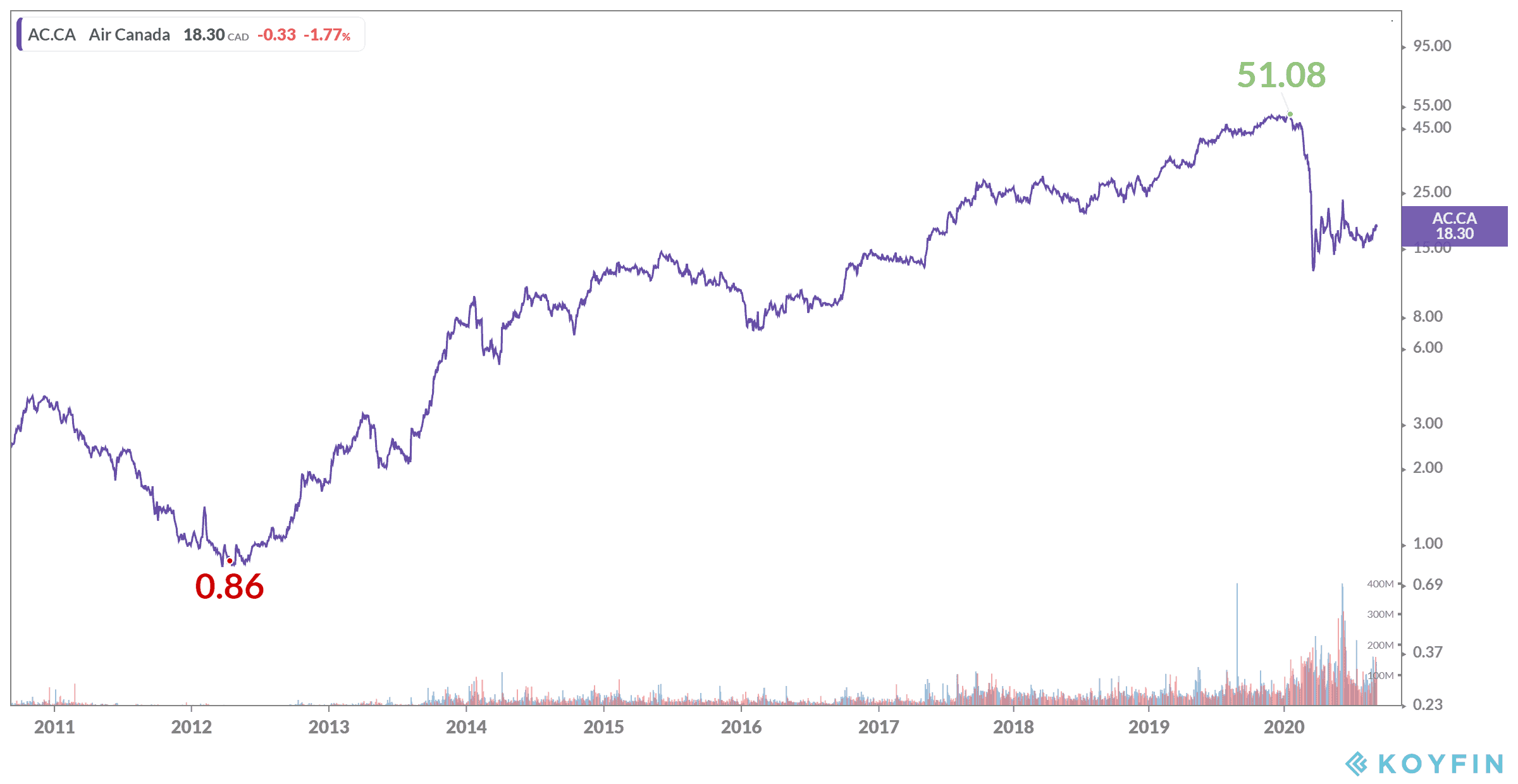

Like I said, investing doesn’t come without risk, and Air Canada (TSX:AC) is certainly risky at the moment. The airline has gone through a hurricane of bad luck this last year with the pandemic. The company almost ceased to exist less than a decade ago, when it made a huge turnaround thanks to reinvestment.

After cutting costs, investing in a fuel-efficient fleet, and acquiring Air Transat, it looked as if Air Canada couldn’t be stopped.

But clearly, that wasn’t the case. No one could have predicted a pandemic. The pandemic brought shares down to lows not seen since 2017. After coming back from the brink of disaster, it looks as though Air Canada could be headed there again.

But therein lies the opportunity for investors to buy low and hold long-term, selling decades from now. There are a few things you can be certain of when it comes to Air Canada. First of all, it isn’t going any where.

The company has 60% of the market share for Canadian airlines. Management has already taken every step it can to get planes back in the air. So you can be sure that if it’s feasible, the company will fly.

That doesn’t help the enormous amount of debt it’s taken on, but its investment into fuel-efficient airplanes does. The company of course will have to take years, even decades to get back what it lost from grounding its airplanes.

However, when it does return to full capacity, it has the fleet of airplanes available to get back in the black as soon as possible.

Meanwhile, this pandemic has allowed the company to find even more cost-saving methods. It already had many on hand due to the crash in share price in 2012. However, with even more savings on hand, it should mean investors can look forward to strong gains once planes are back in the air.

Bottom line

If you look at the performance of 2012, there is no reason why you can’t predict the company to perform in a similar manner in the next decade as well. Should the company grow at the same rate, shouldn’t that bring the stock to even $500 per share a decade from now?

While this can seem like an exorbitant price, if the company can prove that it can get past a pandemic in only a few years, there is no reason that price isn’t a possibility.

That would mean to get to $1,000,000 in a decade from now, it would take an investment of $36,000 as of writing. That’s about half of your Tax-Free Savings Account (TFSA) contribution room.