Investors seeking top high-yield stocks for their TFSA or RRSP portfolios have a number of great stock picks available in the TSX Index today.

Why Enbridge is a top high-yield stock

Enbridge (TSX:ENB)(NYSE:ENB) has a long history of paying investors reliable and growing dividends. The stock trades near $41.50 per share right now compared to $57 in February.

At the current price investors can pick up a 7.8% yield with the potential for steady dividend increase to continue in the coming years.

Why is Enbridge stock down so much?

The company does not produce oil, but it transports nearly one quarter of all the oil produced in Canada and the United States. Fuel demand dropped significantly in the past six months due to pandemic lockdowns, reducing demand by refineries for the crude oil they use to make jet fuel, gasoline, and diesel fuel.

As the global economy slowly recovers, fuel demand should rebound and that will drive up volumes on Enbridge’s main oil pipelines. The company’s natural gas distribution businesses and renewable energy assets continue to perform well.

Enbridge announced decent Q2 2020 results given the challenging environment. Management maintained guidance for distributable cash flow (DCF) of $4.50-4.80 per share for the year. Internal growth opportunities combined with roughly $11 billion in capital projects should boost DCF by 5-7% through the end of 2022.

Enbridge stock looks cheap. You get a great yield and a shot at huge upside in the share price once the economy recovers.

Power Corporation

Power Corporation (TSX:POW) is a Canadian holding company with interests in the financial sector. This high-yield stock owns controlling interest in Great-West Lifeco, IGM Financial, and fintech disruptor Wealthsimple.

Power Corp also has international holdings that give investors exposure to some of Europe’s top global companies.

The stock is a great way for Canadian investors to own a basket of insurance and wealth management companies without taking on some of the risks currently faced by the big banks.

Power Corp trades near $26 per share right now and offers a 6.8% dividend yield. The stock sat above $34 in February, so there is decent upside opportunity and the dividend should be safe.

Bank of Nova Scotia

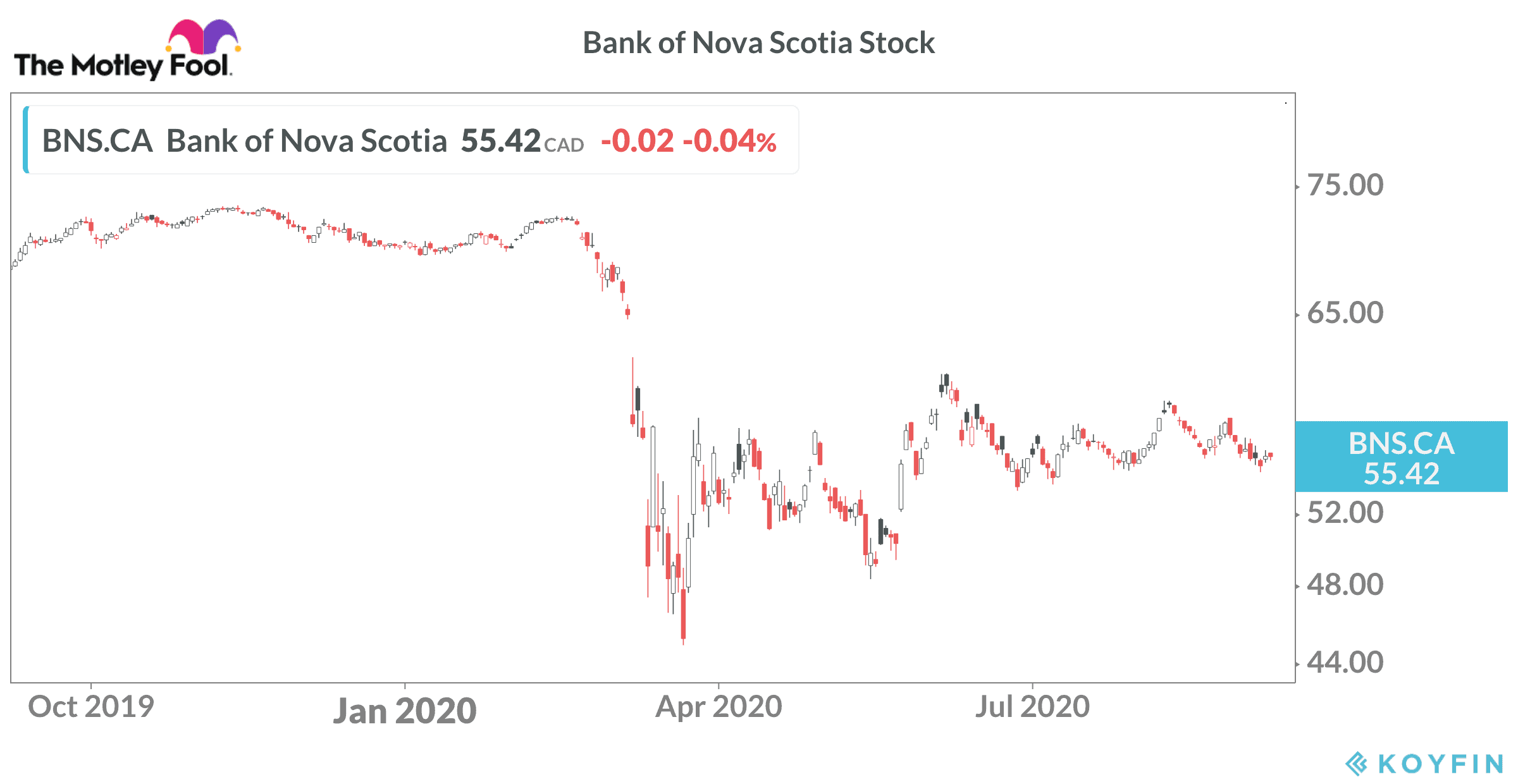

It’s not often that investors can get a 6.5% dividend yield from a top Canadian bank, but that’s the case today with Bank of Nova Scotia (TSX:BNS)(NYSE:BNS).

The bank became a top high-yield stock after it took a hit over the past six months due to worries about COVID-19. All the big Canadian banks booked large provisions for credit losses (PCL) in the past two quarterly reports. Bank of Nova Scotia remains under the microscope as a result of its significant operation in Latin America’s Pacific Alliance countries.

Mexico, in particular, is struggling with the pandemic and that is where Bank of Nova Scotia has a large presence. Colombia, Peru, and Chile round out the Pacific Alliance members.

Bank of Nova Scotia stock trades close to $55 per share at writing. Near-term volatility should be expected, but the bank is well capitalized and the distribution should be safe.

Five years from now the stock could easily be back above $70 per share.

The bottom line

Enbridge, Power Corporation, and Bank of Nova Scotia are all top high-yield stocks that should continue to growth their dividends in the coming years.

The shares look cheap today for TFSA and RRSP investors with buy-and-hold strategies.