Public companies with top government contracts are great stocks to buy as the market rebounds from the COVID-19 shock. What’s more, many options issue steady dividends to boost your retirement goals.

For example, AirBoss of America Corp (TSX:BOS) distributes a 2% dividend yield to shareholders at Tuesday’s share price of $14.20. Even better: the firm has developed exciting new revenue streams, sparking interest among investors.

More specifically, the AirBoss Defense Group has partnered with NATO governments, including Australia, the U.S., and Canada, to provide protective equipment to the military.

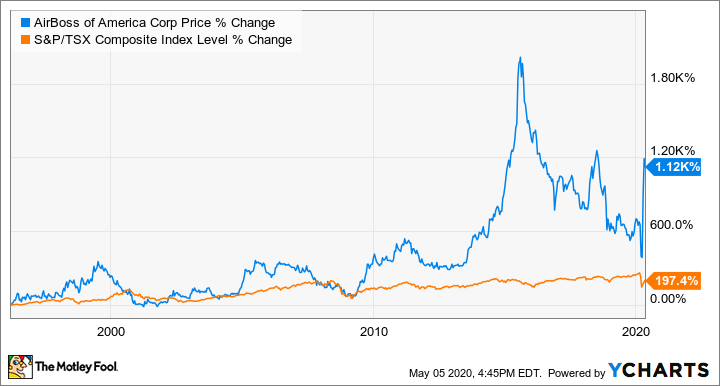

With exceptions, the stock has done very well at exceeding the returns of the S&P/TSX Composite Index.

About five years ago, the stock experienced a substantial, speculative rise. Until recently, shareholders have felt some pain during the natural downward correction. Today, the stock seems to have matured past significant, unpredictable price corrections and has hit a new uptrend.

Fighting the Covid-19 crisis with NATO

Notably, the Airboss Defense Group supplies the U.S. and Canadian military with respirators, chemical/bioprotective masks, and personal protective gear to fight the COVID-19 crisis. Further, the AirBoss Defense Group is a crucial supplier of the U.S. White House task force for the coronavirus response.

If you don’t own Airboss stock in your retirement portfolio, I recommend any stocks with strong military ties.

The company is building a centralized purchasing system strategically. This foresight will reduce costly sales and client maintenance costs and increase the bottom line. Besides, government contracts are also remarkably, if not notoriously, profitable.

Innovative healthcare products boost market returns

Above all, AirBoss released a new product that will revolutionize how governments maintain the health of their soldiers. The firm is now supplying NATO militaries with a high-tech blast gauge that sits on the uniform of military personnel. The blast gauge will absorb explosive pressure and send the information to a satellite.

This crucial health intelligence will automate the soldiers’ medical file updates. Healthcare professionals can use this information to improve therapeutic treatment plans. Hopefully, when the military personnel retires, the soldiers will receive fair disability pay based on their medical records.

In the United States, a Congressional order mandates the use of this technology in the field. The pressure gauge has a one-year shelf-life, sufficient to outlast typical deployment timelines. Moreover, the one-year replacement assures Airboss shareholders a dependable, recurrent revenue stream.

Responsible production rebuilding critical industries

Airboss of America produces these goods in the U.S. states of Michigan, North Carolina, and Maryland. The firm uses intelligent machinery that requires around 150 employees to manufacture and distribute health and safety technology.

With vehicle sales down, the Airboss Defense Group leverages the abundance of skilled manufacturing labour in the Detroit area. Unemployed workers from the car industry construct small motors and other crucial parts to assemble this protective gear.

Foolish takeaway

AirBoss stock will turn out to be a winner in 2020. The best part about investing in AirBoss is the ability to invest in a top government contractor that doesn’t finance weapons. In fact, all available Airboss solutions are protective, not offensive.

Airboss stock is up 61.92% this year. By contrast, the S&P/TSX Composite Index has lost 13.2% of its value due to the COVID-19 health crisis. This stock is therefore a perfect addition to any TFSA or RRSP stock market portfolio. Higher than market average returns this year are a possibility with stocks like Airboss.