North America’s leading energy infrastructure and utility giant Enbridge (TSX:ENB)(NYSE:ENB) stock has traded mostly sideways over the past three years, but the firm’s dividend-growth policy and strong cash flow generation could support significant investment returns over the next decade.

The big question of whether Enbridge stock could deliver a 100% return to its investors could be a very simple one to answer.

This is definitely not a high-growth investment but a slow and steady dividend-growth-powered, income-compounding ticker that could produce wonderful reinvestment returns for patient investors, with share price increases as lucrative bonuses.

Returns may therefore depend much on one’s patience to allow the position to compound itself and to double over time.

Actually, shares in this giant have done great historically, and chances are high that they could outperform again thanks to the company’s strategic moves to refocus on its core businesses and recent share price sideways swings that could end in a pop up when general investor sentiment finally warms up to the energy sector.

Historical performance

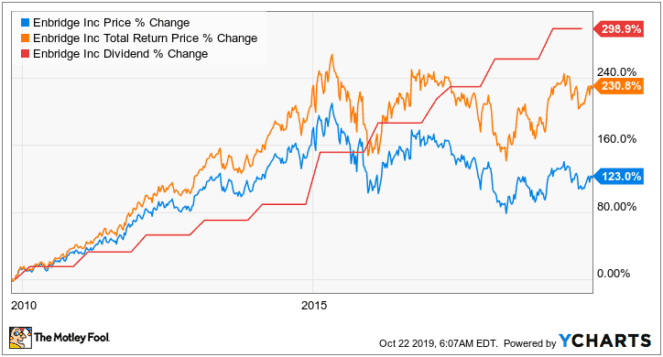

ENB 10-year investment returns and dividend increases to October 21, 2019.

Past performance does not necessarily predict future returns, but early believers in the company’s business prowess may have realized a 230% position gain over the past decade, even after some recent share price turbulence. And we can witness the power of dividend growth and reinvestment that has added almost 110% returns to the 123% capital gain.

Can the investment double again?

There’s still so much growth potential on this resilient and defensive energy play today, and an investment made on the stock today could still realize sizeable returns from both capital appreciation and from dividend growth and reinvestment.

A case for capital gains

Enbridge boasts of highly regulated cash flows as 98% of its expected earnings before interest, taxes, depreciation, and amortization expenses (EBITDA) for 2019 is already secured in long-term contracts to make it one of the best defensive plays on the TSX.

Further, the company’s earnings and cash flows aren’t necessarily dependent on oil prices but on contracted volumes that are projected to steadily increase over the coming decade as oil producers increase their output.

Actually, oil pipelines are already in short supply. The Alberta market demands more of this infrastructure, and the company is one of the best-placed players to step up construction efforts in this near-monopoly service segment.

The company has a strong pipeline of growth capital projects for the 2020 to 2023 period worth $10 billion, and this is on top of a strong $9 billion growth budget for 2019. These projects can be reasonably expected to power a high single-digit earnings growth over the coming years.

I like the company’s declining leverage, too.

Management is targeting a consolidated debt-to-EBITDA multiple of 4.5 to five times for this year, and this is expected to improve further to around 4.25 times by 2021. This is a remarkable achievement from a six times multiple three years ago.

Reduced financial leverage and a sustained earnings and cash flow growth could reasonably attract a better equity valuation.

Strong dividend-powered returns

Shares yield a juicy 6.2% annualized dividend yield today.

This company has been growing its quarterly dividend at an impressive rate over the past 26 solid years, and the expected high single-digit growth in distributable cash flows over the next five years could enable management to keep increasing the high-quality payout.

I expect the company to follow through on its 10% annual dividend-growth guidance for 2020, as it has done already in 2018 and 2019. Even if the dividend-growth rate could slow in the coming decade, there’s still so much potential for a dividend-reinvestment strategy to produce double-digit compounded returns in a TFSA account over the long term.

And I wouldn’t worry about recessions much. This company continued raising its dividend, even during periods of oil price crushes and economic recessions. It could do it again.

Foolish bottom line

I bet that Enbridge stock can still produce phenomenal investment returns to patient investors over the coming decade, especially if one reinvests the growing dividend over a long time horizon.