For the second time this week, an analyst is boosting his rating on Roku (NASDAQ: ROKU). Mark Mahaney at RBC Capital is lifting his call on shares of the streaming-video specialist from sector perform to outperform. He’s also jacking up his price target on Roku from $107 to $155, a new price goal that suggests 33% of upside from current levels.

Mahaney downgraded the stock more than three months ago, a move that may seem like a smart call given the brutal sell-off in the stock over the past few weeks, but Roku shares have actually moved 27% since his downgrade. Mahaney joins Tim Nollen at Macquarie, who also updated his previously neutral stance to an outperform position, along with a higher price target a day earlier. There’s no such thing as easy money out there, but it’s encouraging to see a stock get back-to-back days of upgrades after a brutal correction since peaking in early September.

The timing couldn’t be better

It’s always interesting to watch what Wall Street does in the weeks between a quarter’s end and when that company reports fresh financials. Analyst moves ahead of earnings season tend to be based on how they feel the market will react following a company’s financial release.

RBC’s Mahaney argues that the stock is more compelling following its recent 31% pullback, but that obviously wasn’t the case at the time of his early July downgrade. You can upgrade a stock based on a stock correcting, but when the price target gets sauced up, it’s a pretty bullish indicator. Mahaney sees Roku as one of the best ways for investors to play the streaming revolution, and he views the company’s fundamentals as some of the strongest among small-cap internet stocks.

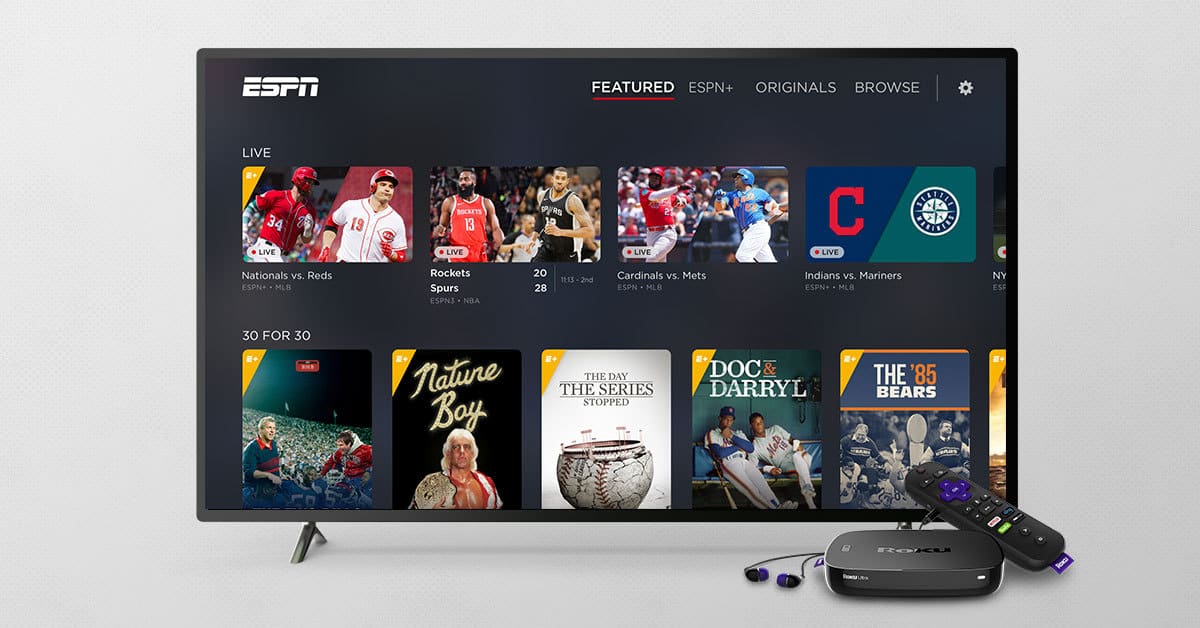

Roku has been one of this year’s hottest growth stocks, nearly quadrupling in 2019. It won’t report until much later this earnings season. Its third-quarter results are unlikely to be announced until early November, or roughly four weeks from now.

A lot can naturally happen between now and then, but the narrative for Roku remains the same: It’s building its audience rapidly, up 39%, to 30.5 million accounts over the past year. The glut of new services rolling out in the coming months will only help increase Roku’s popularity as the platform that plays nice with all of the leading services.

Analysts probably don’t want to be caught with bearish or even neutral calls when Roku reports next month. Its last quarter was a stock-catapulting blowout, and there’s no reason to think that folks aren’t leaning on their Roku systems more than ever. As bad a beating as the stock took over the past month, it wouldn’t be a surprise to see it inch higher leading into its third-quarter update.