The management of Guyana Goldfields (TSX:GUY) overestimated the potential gold reserves by 1.69 million ounces, leading to a 43% decline in reserves. On top of that, a popular ETF has decided to eliminate exposure to junior gold miners. These two events led the stock to drop by more than 80%. However, the firm’s long-term fundamental outlook remains favourable and is expected to strengthen going forward.

Better estimates for Aurora Gold Mine

Guyana’s Aurora gold mine has 4.9 million ounces of gold. After some inaccurate estimates that led to overinflated reserves, management has taken some drastic measures, such as replacement of the key executive team, appointment of a non-executive chairman, and re-focused on high-margin/high-return exploration opportunities.

Although the management doesn’t have a strong track record of forecasting reliable and accurate models, the current team had released an in-depth model with more reliable production and costs forecasts.

In addition, Aurora is the highest-grade gold mine in the industry, extracting around 2.6 grams per tonne (g/per T). This is well above other close competitors’ goldmines like Kinross Gold, Tahoe Resources and Yamana Gold, which can only produce around 0.7g/per T.

Expected to improve margins

Based on the management’s forward guidance for 2019, revenues and margins should stabilize and improve going forward.

Guyana Goldfields is expected to produce around 150k (mid-point) ounces of gold by the end of 2019. Considering that gold prices are on an upward trend, I believe the average price will be around $1,320 per ounce until the end of 2019.

Using these conservative estimates, we should arrive with a forecasted 2019 revenue of $198 million. In regards to operating margins, I took the midpoint of all-in sustaining costs (AISCs) of $1,200 per ounce.

Essentially, AISCs are an accurate measure for mining companies, as they take into account “the pertinent costs of mine maintenance (on-site mine and administrative costs, royalties and production taxes, byproduct credits, permitting costs, smelting, refining, and transport) as well as behind-the-scenes costs that aren’t often associated with on-site mining but still factor into overall expenses,” according to Fool.com writer Sean Williams.

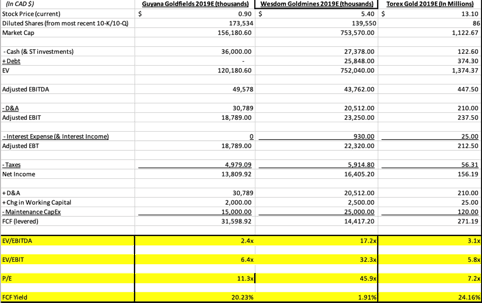

After deducting AISCs, operating margins or EBIT should be at $18 million and EBITDA around $48 million. This gives us an EBITDA margin of 25%, in line with 2018 EBITDA margin.

To arrive at the 2019 levered free cash flow (FCF) on an adjusted basis, I have deducted interest expense, taxes, and maintenance capex (capex to keep the firm competitive), as well as added the change in net working capital of $2,000 (assuming it’s positive going forward) and depreciation and amortization. I believe the interest expense for 2019 would be close to zero, as the firm paid off the remaining $35 million long-term debt, virtually making it debt-free, at least for 2019.

Based on these assumptions, the firm should generate approximately 20% FCF yield in 2019 — better than its competitors. I believe margins are expected to improve further in 2020 and beyond, as the management successfully executes its cost-reduction measures.

As you can see from the 2019 forecasted comparables valuation table above, the stock looks very cheap relative to its closest competitors like Wesdom Gold and Torex Gold, on an EV/EBITDA and EV/EBIT basis, along with having the highest FCF yield on an adjusted/normalized basis.

Even better, the company can self-fund its capital expenditures for future growth using its strong and adequate cash flow and doesn’t need to issue any large amounts of long-term debt. The firm’s high FCF yield and low leverage should make it less risky in contrast with its industry peers.

In conclusion, although there are some key risks in regards to management’s history of overinflated forecasts and the nature of the mining business in general (commodity price risk, cost overruns, delays, etc.), I believe these risks are overblown and the current price ($0.93) should provide investors with an excellent risk/reward scenario and a potential to double their investment.