Being able to separate true mega-trend industries from faddish ones isn’t easy. But sometimes, there are strong signals that make the answer quite clear.

In the burgeoning pot industry, recent interest from major beverage companies is making it more and more difficult for skeptical investors (myself included) to question the “realness” of the opportunity.

And it doesn’t look like that interest is slowing anytime soon.

Pot ‘n pints

Citing sources close to the matter, The Globe and Mail said earlier this week that Anheuser-Busch Inbev, Pernod Ricard, Heineken Holding, Coca-Cola Co. and Diageo PLC are all taking a look at Canadian marijuana companies as a possible way of cracking into the business. According to the report, the beverage giants have been meeting with various cannabis producers, talking to executives and touring their operations.

Nothing has been confirmed, though. And the drink companies are giving their standard “following-the-space closely” response as to what their ultimate objectives are.

“There are still many unknowns regarding the long-term commercial and societal impacts of marijuana legalization,” said AB Inbev spokesperson Aimee Baxter. “It is our hope that the public health community and policy makers are examining this issue carefully so that marijuana is regulated appropriately where it’s legal.”

Still, the news is kind of a big deal to me.

The threat is real

Why? Well, it clearly suggests that beverage makers continue to be nervous about 1) the threat to alcohol sales that marijuana legalization poses, and 2) being left behind by faster, more forward-thinking rivals.

Remember: this news comes after Molson Coors’s blockbuster joint venture with Hydropothecary (TSX:HEXO) as well as Constellation Brands’s big $4 billion investment increase in Canopy Growth (TSX:WEED)(NYSE:CGC). It’s obvious that these moves have reverberated throughout the industry, with other drink companies now looking to play catch up.

Thus, if you’ve ever been unsure about the upside potential of marijuana stocks, look no further than the increased interest they’re stirring up among global beverage gorillas. The threat to alcohol sales is real. And so are the billions of dollars that will surely funnel to the marijuana industry over the long haul.

So, should we plunk all of our money into marijuana companies in anticipation of more deals? Of course not.

First, The Globe article didn’t mention specific marijuana companies that are on the M&A radar.

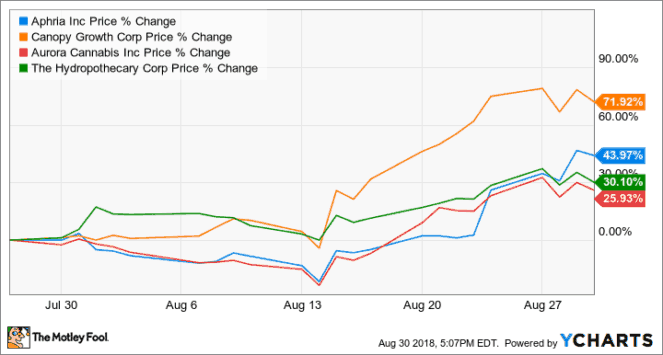

Second, pot stocks, as a whole, have flown ever since Constellation’s increased stake in Canopy. Even after a small dip late this week, the likes of Canopy, Hydropothecary, Aphria (TSX:APH), and Aurora Cannabis (TSX:ACB) are all up more than 25% over the past month.

Despite the positive buzz surrounding the industry, bumped-up valuations, coupled with the fact that it’s difficult to bet on specific plays, still make weed stocks a speculative bet in my books.

That said, the long-term upside is undeniable. And the heightened attention from global beverage behemoths is highly comforting. Thus, I’d now be comfortable dedicating a small portion of my portfolio — earmarked for speculative purposes — to a basket of three or four major weed companies.

I’ve finally come around, Fools. But, of course, the value investor in me will likely still hold out for a pullback.

Fool on.