As an income investor, few things worry me more than a big dividend cut.

Aside from the lost income, Mr. Market doesn’t take too kindly to it. After a company slashes its payout, fed-up investors typically sell their shares in droves. Of course, this can also lead to attractive bargain opportunities for those sitting on the sidelines.

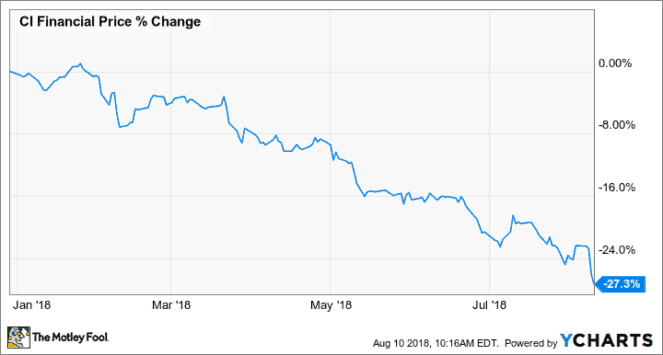

Well, CI Financial (TSX:CIX) might be one of those value opportunities. Shares of the asset management giant are down about 7% after significantly slashing its dividend on Thursday. But there’s good reason not to freak out.

Let me explain.

Dimming dividend

First, the details: up until Thursday, CI was paying an annualized dividend of $1.41. But now, it’ll only be paying an annual rate of $0.72 — nearly a 50% haircut. It will be paid quarterly over the next six quarters.

So, why did management make this move? Well, there are two reasons.

First, it boosts CI’s financial flexibility — something the company desperately needs in today’s wealth management space. The company continues to struggle with net outflows — investors pulling their money from CI’s mutual funds — due to weak performance and the rising popularity of passive-investing vehicles. In Q2, average assets under management dropped yet again — $139.5 billion vs. $141.9 billion in Q1.

But here’s the main reason for the dividend slash: it allows CI to buy back its undervalued shares. In fact, management thinks the stock is so cheap that it’s committing $1 billion to share repurchases over the next 12-18 months.

“With this change, we will have increased flexibility to invest our free cash flow in the best available opportunities to the benefit of our company and its shareholders,” said CEO Peter Anderson. “Today, we strongly believe that the best use of free cash flow is to aggressively buy back CI shares because they offer such compelling value. Each share bought back is accretive to earnings.”

Despite the headwinds, CI still generates boatloads of cash. In the first six months, free cash flow has already reached a record $330 million. So, when you combine that high level of cash flow with CI’s beaten-down stock, it’s tough to argue with management’s reasoning:

Remember, Fools: when compared to dividends, buybacks are more flexible for management and taxed more favourably for us. But they really only make sense for a company when its shares are undervalued.

In the past, CI has returned the majority of its free cash flow through a combo of dividends and share repurchases. As long as that doesn’t change (CI says that it won’t), tilting the mix towards buybacks at this time seems prudent.

The Foolish bottom line

CI continues to face strong headwinds. But given its heavy cash flow generation, depressed stock price, and still-decent dividend (it yields about 3.3% at current levels), I’d give management the benefit of the doubt — for now.

Fool on.