“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” – John D. Rockefeller

I have a wife and kids. So, it would be unwise (and unsafe) for me to say that dividend income is the only thing that gives me pleasure. But when ranking the things that make me happy in life, I’ll say this: dividends are definitely near the top.

There are just a few conditions. The dividends need to be hefty. The dividends need to be growing. And, more importantly, the dividends need to be reliable.

There aren’t many stocks that pass that test. So, when you come across a company that does, it’s always worth considering.

One such stock is RioCan Real Estate Investment Trust (TSX:REI.UN).

Let’s take a look.

RioCan do it

If you aren’t familiar with RioCan, don’t worry. The business is simple. You’ve also probably walked into the company’s properties dozens (if not hundreds) of times.

See, RioCan is a real estate investment trust (REIT) that owns and develops retail-focused properties. It’s basically a giant landlord that rents out space to retailers. And since it’s a REIT, the company must distribute a good portion of that income — usually 85-95% — to investors.

Now, I know what you’re asking. Isn’t brick-and-mortar retail a bad place to be given the rise of e-commerce gorilla Amazon?

Generally speaking, yes. But when you consider RioCan’s massive scale — 294 properties across Canada — it’s able to attract the strongest and healthiest names in retail. In other words, its tenants tend to have the scale or differentiation needed to fight off online disruption.

For example, its biggest tenants include top-dogs like Canadian Tire, Shoppers Drug Mart, Loblaw, and Wal-Mart — not exactly companies that struggle with rent money.

What does all of this lead to? A very safe and steady dividend for RioCan investors.

Check it out.

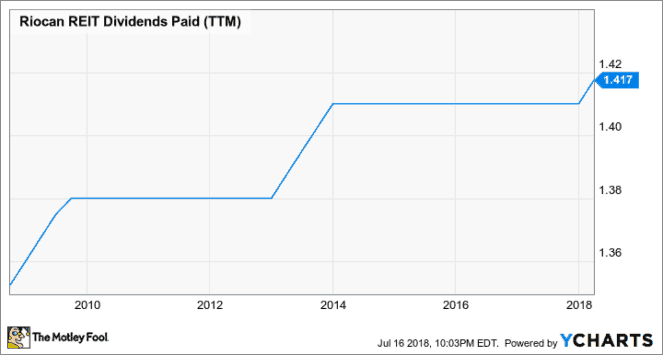

While the dividend isn’t growing at a breakneck pace, it’s as stable as they come. Moreover, it comes on a monthly basis.

In fact, management recently announced its distribution for July of $0.12 per unit. It will be payable on August 8 — but you need to be a unitholder of record as of July 31 to lock it in.

So, lock it in!

With the stock currently boasting a 5.8% dividend yield, RioCan looks like a solid value. Also, investors have generally done well in recent years when jumping in around this $24 price level.

The Foolish bottom line

There it is, Fools: my bullish take on RioCan. Now, it isn’t without risks, of course. The threat of rising interest rates and a new strategic shift — management wants to focus on bigger cities — bring plenty of uncertainty over the shares.

But if you’re able to handle some near-term volatility, RioCan’s long-term income potential is tough to pass up.