There’s no way around it: in order to build big wealth in the market, you need to buy things when others don’t want them.

This does a couple of things. First, it helps limit your downside — by definition, out-of-favour stocks have already fallen significantly in price. And second, it helps maximize your upside.

Of course, there’s usually a very good reason why investors don’t want a particular stock. But if you think that their concerns are somewhat irrational, a big buying opportunity could be staring right at you.

Well, right now, I think Magna International Inc. (TSX:MG)(NYSE:MGA) represents one of those opportunities.

Let me explain.

Tariff trouble

Shares of the auto parts manufacturers are down about 10% over just the past few weeks.

And it’s no secret why.

Trade war fears are absolutely spooking investors. If President Trump goes ahead with auto tariffs, the repercussions on Magna’s business — and the Canadian auto sector as a whole — will be significant. Magna generates the majority of its sales from Detroit-based car companies. And it hires over 25,000 employees in the U.S. across 11 states.

This is undoubtedly worrisome stuff. That said, here are a couple of reasons why I still like the stock.

Dividends

Magna’s dividend is solid — and it grows.

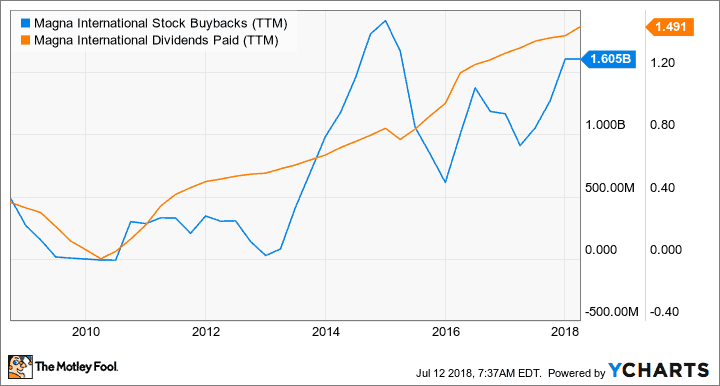

Management has a strong track record of increasing the payout, suggesting that they’re firmly committed to shareholders. Magna also has a long history of significant share buybacks.

Check it out.

But here’s the key: those big capital returns are backed by strong revenue growth and free cash flow. Moreover, the company has very little in the way of debt. Currently, its debt-to-equity ratio sits a comforting 0.27.

Put it all together, and I can only conclude one thing: Magna’s fundamentals remain healthy.

Valuation

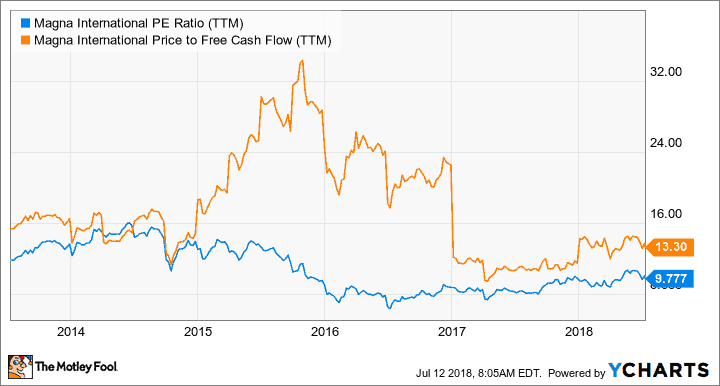

The other big reason why I like Magna is obvious: the shares seem inexpensive.

Thanks to the recent punishment laid down by Mr. Market, Magna’s price multiples are pretty low relative to recent years — both on an earnings and free cash flow basis.

When compared to U.S. counterparts like Dana Inc. and BorgWagner Inc., Magna’s current multiples are also relatively low.

Throw in a decent 2.1% dividend yield, and it’s clear that Magna is at least attractively priced.

The Foolish bottom line

There you have it, Fools: a couple of reasons why I think Magna might be a successful turnaround play.

Obviously, the stock isn’t without risks. Last week, fellow Fool Joey Frenette nicely outlined many reasons to stay away from — and maybe even short — Magna. So, it’s definitely not the best for risk-averse investors.

But for enterprising investors looking for tasty odds, Magna’s solid fundamentals and cheapish valuation may very well provide it.