Small cap value stocks significantly outperform their large cap counterparts sometimes — even more so when the selected basket has some positive macroeconomic dynamics working in its favour. MCAN Mortgage Corp. (TSX:MKP) and Firm Capital Mortgage Investment Corp. (TSX:FC) are but two examples of small cap financial stocks that are outperforming their larger mortgage sector participants on price gains this year while offering unparalleled income yields.

While investors in Equitable Group Inc. (TSX:EQB ) have lost 21% of the stock’s value year to date, and those in First National Financial (TSX:FN) are sitting on zero total returns thus far in 2018, MCAN Mortgage and Firm Capital have offered modest total gains of +4% during the period, thereby defying the generally negative investor sentiment surrounding the mortgage origination sector after the new regulatory requirements were effected on January 1, 2018 that could significantly slow down business growth in the Canadian retail mortgages sector.

MCAN has significantly outperformed the other three players mentioned by a wide margin over the past three years by returning 82% to shareholders, trumping First National’s 69.8% in total returns and Firm Capital’s 31%, while Equitable Group 8.5% of their investors’ capital.

The smaller mortgage players have strong prospects for continuing to generate superior income yields and offer better price returns while shaking out industry headwinds going forward.

MCAN Mortgage

MCAN Mortgage Corp. is a small mortgage investment company that’s generating a reliable stream of income by investing funds in mortgage portfolios as well as other types of loans and investments, real estate, and securitization investments.

The stock pays a $0.37 quarterly dividend per share, thereby yielding 8.9% on a forward-looking basis. The dividend was increased by 15.6% for the last quarter of 2017, marking the stock’s fourth dividend increase in just three short years, with the company’s CEO remarking that the latest dividend increase reflected the company’s confidence in the strength of its core business it currently expects going forward.

There is room for continued income growth with the recent margin expansions MCAN has been witnessing in its mortgages portfolio.

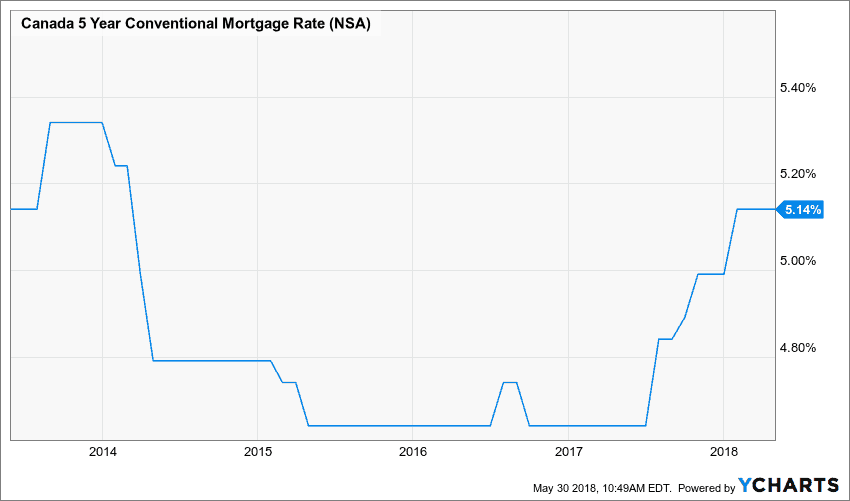

The recent sustained increase in general interest rates in Canada over the past year has been a welcome development for lenders. MCAN employs leverage by issuing term deposits, and the spread between term deposit interest rates and average mortgage lending yields in its portfolio has been widening recently, especially in the corporate segment, thus generating more profitability for MCAN.

Further, while the individual unsecured mortgage origination has slowed down in the first quarter — and probably during this second quarter due to regulatory changes — MCAN managed to nearly double the value of its new corporate mortgage originations during the first quarter. A sustained growth in this sector could propel portfolio growth forward for 2018.

Most noteworthy, MCAN has maintained its 10% per annum growth target for corporate assets. Indeed, regulatory changes may slow down business in the first half of 2018, but adaptation to the new dispensation may result in a sustained rebound and higher quality loan portfolios for the whole industry.

MCAN has never missed a dividend payment.

Firm Capital Mortgage Investment Corp.

Firm Capital is a Canadian financial provider that acts as a non-bank lender providing residential and commercial short-term bridge and conventional real estate financing, including construction, mezzanine and equity investments.

Firm Capital has religiously paid a regular $0.078 monthly dividend per share since 2011, which is good for a nice 7.07% forward yield. The stock also pays out a special dividend annually in December. The company has never missed a dividend payout since 2011, and its most recent 12-month cash pay-out rate is just 62%.

Investor takeaway

MCAN and Firm Capital are low beta stocks with five-year betas of 0.3817 for MCAN and -0.0521 for the later. They do not trend much with the general equity market as much as Toronto Dominion Bank (TSX:TD)(NYSE:TD), which has a stock beta of 0.98 (too close to one) and seems much more correlated with the general Canadian stock market. From a risk management and portfolio diversification perspective, it would reduce your overall stock portfolio risk to add some low beta stocks.

I’m more inclined to pick up MCAN right now, not only for its higher dividend yield, but also for its more consistent growth trajectory.