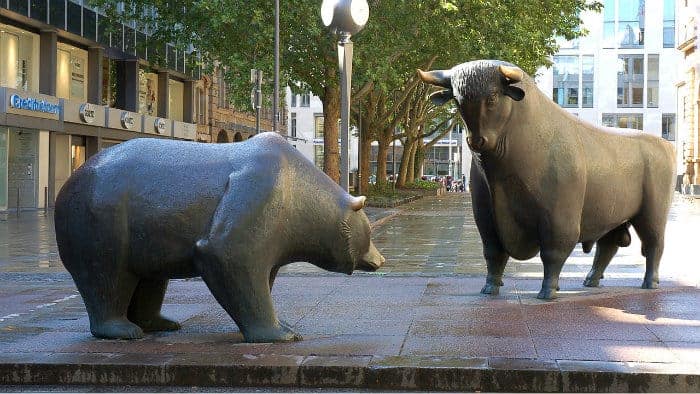

With global stock markets having experienced declines in recent months, it is understandable that many investors have become increasingly bearish. After all, there are clear challenges facing the world economy, including the prospect of higher inflation and rising interest rates.

However, history shows that stock markets have always recovered from corrections and bear markets. As such, investors may wish to adopt a generally positive outlook on the future for the stock market. Otherwise, they may miss out on the growth opportunities that will inevitably present themselves.

Time periods

Clearly, an investor who is generally pessimistic about the outlook for the stock market will sometimes be correct. The past performance of all stock indices shows that they are often volatile and can experience peaks and troughs. As such, avoiding buying stocks could lead to short-term outperformance relative to investors who have taken positions in a variety of companies.

However, over the medium and long term, individuals who avoid investing their capital in stocks could face significant challenges. For example, inflation eats away at returns over a prolonged period. Since stock markets generally offer total annualised returns of around 7-8% over a sustained time period, it is generally accepted that they offer a very high chance of achieving a real return.

For bearish investors, though, assets such as cash and bonds may lead to the loss of purchasing power over the long term. While such investors may avoid the volatility and risk of the stock market, ultimately they may end up being disappointed by their returns.

Volatility

One reason why many investors adopt a bearish stance on stocks is fear of recording losses. This is an understandable concern, since it is frustrating to see the capital generated through hard work decline in value.

One way of addressing this concern is to accept that stock prices will always be volatile, and it is only when a position is closed that a loss occurs. Most investors will have examples of their own when they purchased a slice of a company only for it to decline in value before then recovering to generate a profit upon sale. In fact, this is a relatively common occurrence, since it is exceptionally difficult to buy any company when it is trading at its lowest ebb.

Simple strategy

Therefore, by focusing on the end result of a decision to invest in the stock market, rather than on the volatility that is likely to occur in the meantime, it may be possible to adopt a more upbeat outlook.

Doing so could allow an investor to capitalise on what may prove to be a stunning future growth rate. Although the S&P 500 has risen from 100 points in 1980 to a level of 2,640 points today, history suggests that it will move higher in the long run. Therefore, having exposure to the stock market appears to be the right strategy to adopt at the present time.