The traditional retail business model is going out of favour, and shopping mall operators are facing significant profitability challenges, yet Slate Retail REIT (TSX:SRT.UN) has found a defensible, thriving, and profitable retail real estate niche that is still growing and generating reliable cash flows to support the REIT’s rich 8.8% distribution yield going forward, making the REIT a potentially good income play candidate.

Slate Retail REIT is an open-ended real estate mutual fund trust constituted in April 2014, and it owns 86 grocery-anchored retail commercial properties comprising 11.2 million square feet of gross leasable area located in the United States.

The REIT’s target tenant market has proven to be resilient over the past four years, with Slate averaging a portfolio occupancy rate of around 94.1% over the period.

Although there’s still a severely negative sentiment among investors as far as retail sector in the United States is concerned, and the sector may still see elevated bankruptcy levels going forward, it is important to note that not all retailers are being affected the same.

Slate’s tenant portfolio has Wal-Mart Inc., Publix, and The Kroger Co. as the three important grocer anchor clients, and the REIT has maintained a 100% grocery-anchored occupancy rate over the past three consecutive reported quarters. Slate only suffered five out of the 2,655 recorded U.S. retailer store closures in 2017.

Grocery stores, restaurants, fitness centres, hardware/DIY stores, and other necessity-based retail outlets are still thriving, and the demand for well-located brick-and-morter retail real estate for these businesses is reportedly growing in suburban America, giving Slate a growing tenant market, while other retail REITs are busy defending a declining market.

Strong and reliable distribution yield

Slate REIT’s monthly distribution of US$0.07 is good for an 8.8% income yield on a forward-looking basis today.

The REIT’s funds from operations (FFO) payout rate was a conservative 65.5% for 2017, and the adjusted funds from operations (AFFO) payout ratio was a healthy 81% for last year.

While the threat of rising interest rates in 2018 is real, the REIT is not in serious danger yet, as management entered an interest rate swap agreement for nearly 58% of Slate’s outstanding debt, in which it will pay a fixed interest rate and receive a floating interest rate. The swap has an average term of 3.4 years, which matches the term of Slate’s floating debt term, and this risk-management maneuver has the effect of fixing the REIT’s interest rate.

The swap also has the added benefit of maintaining the REIT’s payout ratios within acceptable levels. A potential 1% increase in U.S. interest rates in 2018 could only raise Slate’s AFFO payout ratio to 88.5%.

Risks

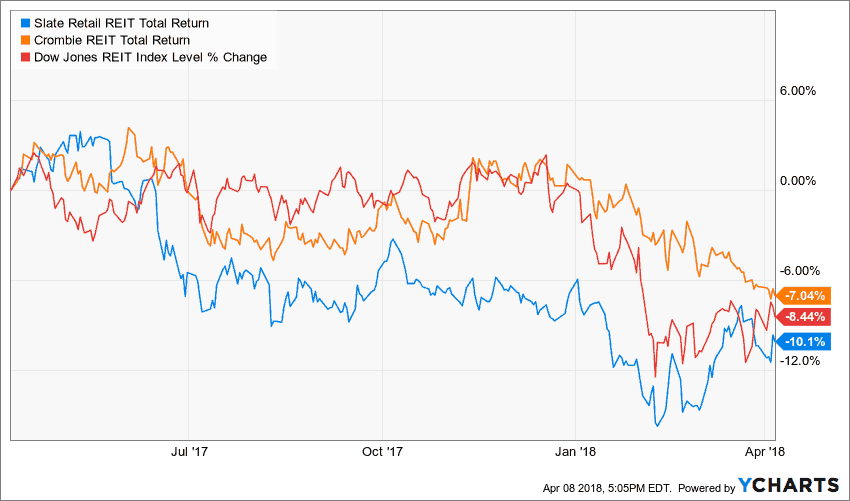

Slate Retail REIT’s units have lost about 10% of their value in a year, as negative investor sentiment impacts traditional retail sector valuations. Like comparable REITs, the units’ market price may remain subdued in the near term.

The old retail business model is under severe pressure from technological advances and the rise of e-commerce giants like Amazon.com and the increased adoption of online business models by traditional brick-and-mortar retail stores may slow the general demand for retail real estate.

However, the most impacted retailers are those in apparel, electronics, book stores, and department stores, and Slate has very minimal exposure to this part of the retail sector. Slate Retail REIT’s focus on defensible grocery-anchored shopping centres and everyday-needs tenancies in densely populated areas is proving resilient enough to survive the death of retail.

Quite concerning is the REIT’s growing debt level, where the total debt to gross book value increased sequentially over the last three quarters of 2017 from 49.6% in the second quarter to 58.9% at year-end. However, it is somehow reassuring that the interest coverage ratio is still a healthy 3.05 times.

Investor takeaway

Slate Retail REIT enjoys a thriving retail real estate business by focusing on a defensive niche, while other shopping mall operators are facing serious survival threats as e-commerce eats into traditional retail model business revenues, driving many retail tenants out of business. The REIT is expanding its footprint in suburban America, and its strong cash flow generation and healthy payout ratios could provide income investors a stable, reliable, and juicy income yield over the next few years.