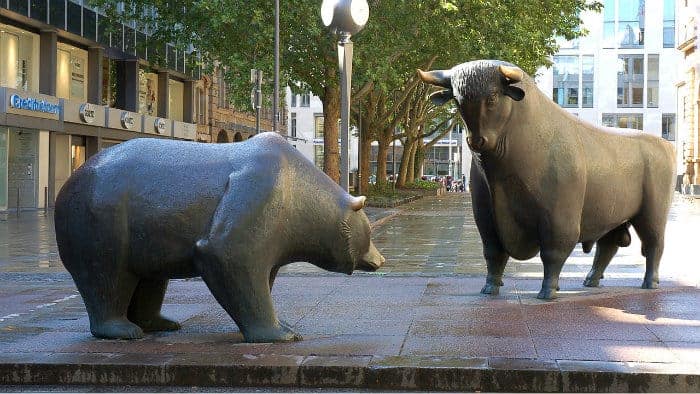

If the markets have gotten you worried, you’re not alone. We are overdue for a bear market, and with stocks continuing to climb, valuations are getting dangerously high. Bitcoin has already taken a big hit after reaching nearly US$20,000 in December, and pot stocks have also fallen sharply after a seemingly endless rise in price.

Are we seeing a bear market start to form?

The TSX has given back many of the gains it accumulated last year, and the Dow Jones has also been on a bit of a roller coaster this year with single-day declines hitting over 1,000 points. Many analysts have long said that stocks are overvalued, and even Warren Buffett recently expressed difficulty in finding good buys on the market.

There are many reasons why the Canadian economy could be in for a tough year in 2018, and with many stocks trading at highs and at large multiples, it could be a perfect storm that is about to come together. Prior to this year, the TSX was up 25% since the beginning of 2016, and it may be overdue for a big correction. In 2015, the market dropped 11%, and although 2017 was shaping up to be a bad year as well, a late rally prevented that from happening.

What should investors do?

One way investors can arm themselves in times of uncertainty is to invest in defensive, or recession-proof stocks. A good way to identify stability is by looking at companies and industries that simply can’t be impacted by a bear market because of their importance to the economy.

Utility stocks, for example, will continue to have consistent earnings, and perhaps there is none better on the TSX than Fortis Inc. (TSX:FTS)(NYSE:FTS) and Hydro One Ltd. (TSX:H). Both stocks have strong customer bases that will provide some consistency in the top line, and both pay an attractive dividend that can ensure you collect some cash, even during tough times.

Another industry that will continue to see lots of demand is waste management. In a bear market, people aren’t likely to have less garbage. In fact, with less disposable income and more people staying home, it could actually increase the amount of trash that consumers need to dispose of.

For that reason, Waste Connections Inc. (TSX:WCN)(NYSE:WCN) is another great buy. Although the company may offer a small dividend of less than 1%, in five years its share price has more than tripled, and in two years sales have doubled thanks to some key acquisitions the company has made. Waste Connections has also not struggled in turning a profit, and it can provide you a lot of stability when you need it the most.

Bottom line

Bear market or not, investors simply need to adapt to the circumstances. That doesn’t mean that you need to reshuffle your portfolio; it may just mean that you need to adjust your expectations and anticipate that until the markets recover, returns may be minimal or non-existent. Investing is a long game, and short-term decision making can saddle you with some big losses along the way.