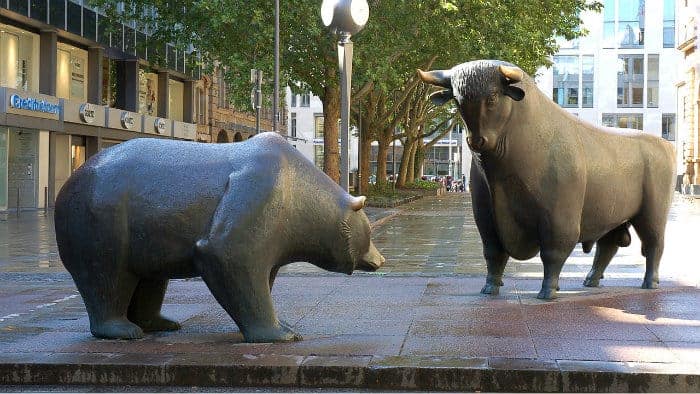

These last two days have been absolute hell for the markets. The Dow plunged ~1,600, marking the biggest single-day point crash of all time. For investors who are just starting out, that has got to be horrifying. But before you panic and hit the sell button, like many others have been doing, it might make sense to take a step back, remove yourself from the heat of the moment, and make an informed decision while you consider the bigger picture.

Perhaps this plunge could serve as a lesson learned if you grew complacent while the U.S. markets hit an inflection point, driving the FOMO (fear of missing out) mentality to new heights. Were you prepared for a correction with a defensive position in your portfolio and ample cash on hand? Or did you feel “stupid” after reading Ray Dalio’s recent comments and following his advice by going all-in on stocks?

Ray Dalio is a genius, no doubt, but I believe his comments were taken the wrong way by many investors — beginners in particular, who were already exhibiting the FOMO mentality. Cryptocurrencies and cannabis stocks were reportedly making overnight millionaires across the board, so, of course, the general public didn’t want to miss out, so they spread their bets on the U.S. markets, bringing them to absurd heights over the month of January.

What should Canadian investors do today?

The markets were long overdue for a correction, and I think there’s still more pain ahead, but investors shouldn’t fret. This is the buying opportunity that you’ve been waiting for, but don’t pull the trigger all at once.

Use a dollar-cost averaging approach and buy the stocks on your radar gradually over time. Toronto-Dominion Bank (TSX:TD)(NYSE:TD) and Manulife Financial Corporation (TSX:MFC)(NYSE:MFC) are two very high-quality stocks that have been absolutely punished over the last few days for no real company-specific reasons. These two firms (and many others) are slated to enjoy huge tailwinds over the next few years, so investors should think of slowly nipping away at these bargains as Mr. Market continues to lower prices across the board.

I believe the correction we’re experiencing will hit U.S. stocks and higher-growth names the hardest. Canadian value stocks, while still at risk of a drastic fall, will be far better buys when we look back in a few years from now. Late last year, I’d noted that the markets would likely rotate out of red-hot speculative plays and into value plays as the speculative cloud of euphoria surrounding cannabis, crypto, and even stocks gradually fades. After the dust settles, it’ll likely be back to boring, old value stocks!

Bottom line

It’s hard to be a buyer in times like these. The markets likely aren’t done correcting yet, so before you get overly greedy on the sales, it may be wise to spread your buying activity in the weeks or months ahead. If you’ve neglected the defensive portion of your portfolio, it may be wise to get back into solid holdings like Canadian Utilities Limited (TSX:CU), which is essentially the “anti-Bitcoin” that’ll allow your portfolio to better ride out the volatility that’s ahead.

Stay hungry. Stay Foolish.