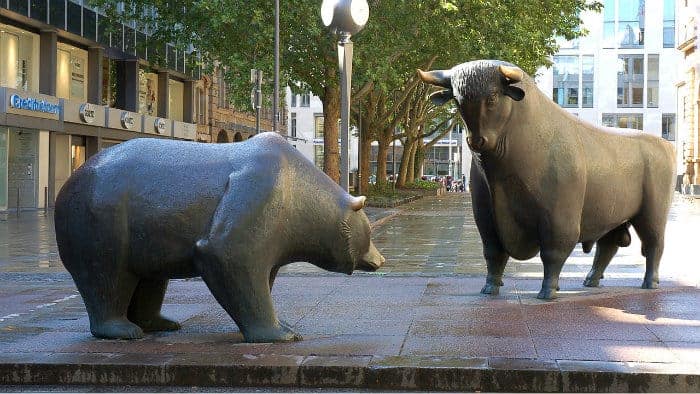

Now that the S&P/TSX Composite Index (TSX:^OSPTX) has surged through the 16,000-point barrier, there is a growing chorus of voices claiming that a market correction is imminent. While there have been some recent signs of economic weakness, it doesn’t appear that a sharp correction will occur any time soon. The reality is that corporate earnings continue to grow, supporting recent market highs and rising company valuations.

Nonetheless, wise investors are prepared for any eventuality, and one of the best means of taking advantage of an improving global economic outlook while hedging against a downturn and market correction is by investing in Brookfield Infrastructure Partners L.P. (TSX:BIP.UN)(NYSE:BIP).

Now what?

The partnership owns and operates a globally diversified portfolio of infrastructure that is critical to modern economic activity, spanning ports, communications towers, toll roads, railways, and natural gas distribution utilities in developed and emerging markets. This endows it with considerable growth potential, because as the global economy strengthens, demand for Brookfield Infrastructure’s assets will grow.

In fact, the International Monetary Fund, or IMF, boosted its forecast for 2017 global GDP by 10 basis points and expects the world economic recovery to continue into 2018 with even stronger growth.

The marked increase in demand for infrastructure is being magnified by the global infrastructure gap, which the World Economic Forum estimates to be as great as US$1 trillion and rising. The shortfall in spending on infrastructure is at its worst in emerging markets, such as China, Brazil, Peru, and India, where Brookfield Infrastructure has considerable direct and indirect exposure.

Improving growth in China, which has been estimated to average up to 6.4% annually, will drive greater demand for metals and coking coal, which are all vital materials for the world’s workshop. That bodes well for more growth for Brookfield Infrastructure, because it owns and operates one of the world’s largest coal terminals located in Australia, which is responsible for providing most of the coal imported by China.

All of this means that Brookfield Infrastructure’s solid performance for the first nine months of 2017 will continue for at least the foreseeable future. For that period, funds flow from operations grew by an impressive 23% year over year to US$857 million, primarily driven by earnings from its latest acquisition of a Brazilian natural gas transmission utility.

So what?

For investors worried about an economic downturn or market correction, Brookfield Infrastructure is a great defensive stock.

You see, because of the vital nature of the infrastructure to modern economic activity, demand for its use remains relatively inelastic, meaning that it is well shielded from an economic downturn. Brookfield Infrastructure’s earnings are further protected by the fact that it operates in highly regulated markets with steep barriers to entry, including the need to invest significant capital to commence operations that are oligopolistic in nature.

As a result, the partnership has some solid defensive credentials, meaning that Brookfield Infrastructure is well shielded from the fallout associated with market slumps when compared to many other businesses.

While investors wait for any economic or market conflagration to blow over, they will be rewarded by Brookfield Infrastructure’s tasty 4% yield. The partnership has an impressive history of hiking its distribution, having done so for the last nine years. The likelihood of further increases is virtually guaranteed. This is not only because of Brookfield Infrastructure’s solid growth potential and defensive characteristics, but also the ability to generate a 12% compound annual growth for funds flow from operations.

For these reasons, Brookfield Infrastructure is one of the best defensive stocks.