Canadian banking stocks have struggled throughout this year due to various unfavourable developments in the Canadian economy.

First, it was a near-collapse situation of Home Capital Group Inc., Canada’s largest alternative mortgage lender, and then it was the overheated housing market in the country’s largest city, Toronto.

These worries kept the share prices of the nation’s largest lenders depressed with Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) and Bank of Montreal (TSX:BMO)(NYSE:BMO) leading the losses.

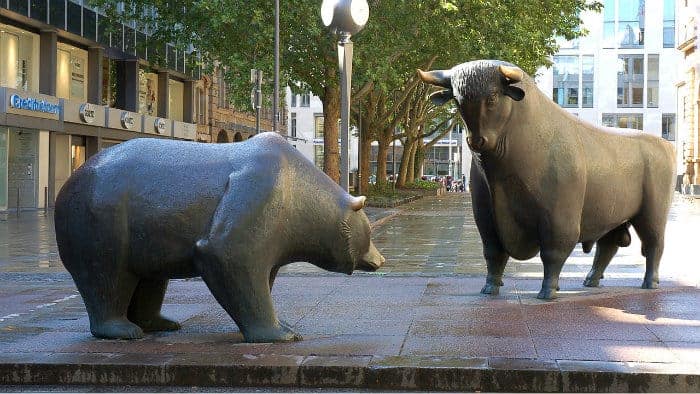

But the third-quarter earnings reports from the “Big Five” banks show these lenders are well positioned to benefit from a very robust economic growth. And there is a good chance that investors will re-visit their bearish stance on Canadian banks, which have consistently provided hefty dividends and long-term growth to income investors.

The latest news on the economic front solidifies the bullish trend emerging for the Canadian banks in the later part of the year.

Data released on August 31, showed the Canadian economy growing at a stunning 4.5% pace in the second quarter, the strongest performance since 2011.

Some analysts now expect the Bank of Canada to raise its benchmark overnight interest rate by 25 basis points as early as this week. Such a hike, which would be the second this year, would put the interest rate at 1%, up from 0.75% set in July. If the Bank of Canada doesn’t move next week, a rate hike later this year seems to be a done deal.

Housing bubble

As the economy expands and unemployment rate falls, Canadians who loaded themselves with a record level of housing debt are more likely to ride through the ongoing housing correction successfully.

Early signs suggest that homeowners are coping with the housing slowdown well in Toronto, and the concerns about market crash were overblown.

There is no doubt that about a 20% correction in home prices in the nation’s largest market since April must have caused some pain for homeowners, but there are no signs that banks’ balance sheets have been compromised.

Investor takeaway

As the Bank of Canada accelerates its monetary tightening, and the housing market emerges from this cooling phase, shares of Canadian banks are poised to outperform.

The best strategy when it comes to investing in Canadian banks is to buy the ones that have been the hardest hit. Over a longer period of time, these banks provide a solid income stream to investors who like to buy and hold these stocks.

Keeping this strategy in mind, I see good value in both CIBC and BMO stocks after their recent pullbacks.