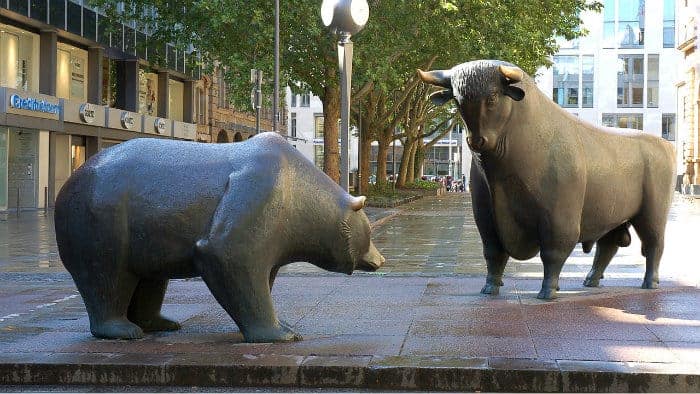

The stock market is generally in a period of either optimism or pessimism. That’s why the terms ‘bullish’ and ‘bearish’ are often used to describe market sentiment. Another way of doing so could be to describe investors as either fearful or greedy, since the dominant emotion of the two can lead to major share price gains or losses in a relatively short period of time.

Of course, all investors wish to buy ahead of a more bullish period of time for the stock market, and sell prior to a more bearish period. Doing so can be tough, but by being a contrarian investor it is possible to use changes in market sentiment to your advantage.

Going against the herd

Clearly, to buy at a low ebb for the stock market and sell at a high point requires an investor to go against the dominant emotion of the wider market. Share prices are rarely low without good reason. This could be because of a recession, industry challenges or internal problems which are hurting a company’s financial outlook.

In such a scenario, most investors will sell up and deem the risks to be too great given the potential rewards. However, contrarian investors would instead go against the investment herd and buy the company in question. Doing so can lead to a period of disappointment and paper losses, but in the long run it can lead to a relatively high total return.

It’s a similar story when selling shares. Market optimism may be high and it may seem as though the current Bull Run will never end. However, no asset price has ever risen in perpetuity, so selling when other investors are optimistic could allow an investor to lock-in profits at the most lucrative point in the investment cycle.

Investor mind-set

As highlighted, being a contrarian investor can be tough. It usually means an investor is wrong for at least a period of time, since it is tough to call the exact top and bottom of a market. This is where a long-term outlook can prove to be extremely helpful, since it can mean greater patience on the part of the investor. Furthermore, focusing on the history of the stock market shows that even when there are major problems facing it which seem insurmountable in the short run, in the long run major stock markets have always recovered to post higher highs.

Clearly, obtaining the right mind-set is easier said than done. Some investors will inevitably find it more straightforward than others to buy when other investors are selling and vice versa. However, by doing so it can be possible to find the most opportune moments to buy and sell shares, which could then lead to higher total returns in the long run. As such, being a contrarian investor may not always be fun or exciting, but it can be hugely profitable over a multi-year period.