You’ve heard it said before: fire insurance is typically much cheaper before the forest fire approaches the city lines.

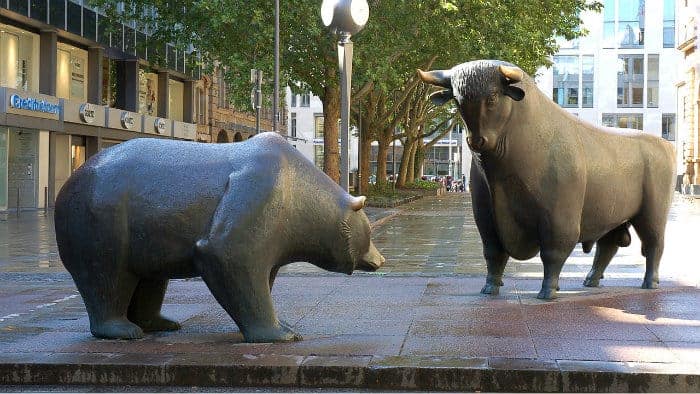

In financial markets, gold has a number of purposes. One of its primary roles is as a hedge to volatility and market downturns. As volatility continues to hover near all-time lows, many investors are now simply brushing off the concept of investing in gold. After all, why put money into a non-productive asset where it will sit and basically follow inflation, when it is possible to invest money in a value-creating company with assets that will continue to provide increased returns over time?

Benefits to having a small percentage of portfolio insurance

The logic goes that productive assets are largely only valuable when consumption trends remain positive. In periods of economic decline, deflation, or large inflationary spikes, corresponding declines in consumption lead to a reduction of the valuations of value-producing assets.

The price of gold, and therefore gold production companies, has traditionally been directly correlated to the demand for gold. While traditionally viewed as a hedge, gold has a few other key purposes, such as a store of value in regions where fiat currency has been discredited, and as a key metal in some industrial and commercial industries.

Buying a gold-related security (or the physical bouillon itself) is just one of many ways of buying portfolio insurance. Index options, building up a cash position, and buying bonds or fixed-income securities are other ways of playing the potential downside in the market.

Lots of options out there

The question many investors have with respect to gold is how to invest. I’ve covered this topic in previous pieces; however, after analyzing the majority of the industry-leading gold producers in Canada, my recommendation remains with Barrick Gold Corp. (TSX:ABX)(NYSE:ABX).

Barrick Gold has performed much better than its peers on a number of key metrics I’ve talked to at length, and the mining company’s growth profile is one that I prefer among its peers.

Bottom line

While many options exist for an investor to hedge a portion of a portfolio, I remain a believer that having a small percentage, perhaps 5%, of a portfolio invested in gold-related securities can provide some security and peace of mind for investors that may be focused heavily on growth stocks or higher-return securities.

The bull market may still have legs for some time given the relatively relaxed monetary policy we are now seeing worldwide; however, it is never a bad idea to have a little insurance tucked away — just in case.

Stay Foolish, my friends.