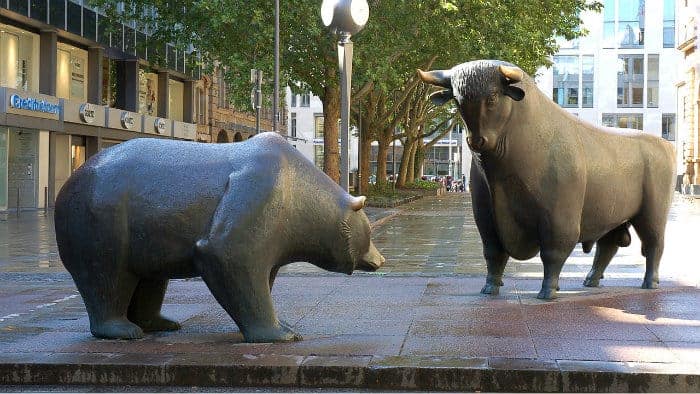

It has been a joyous time for investors as we’ve experienced an eight-year bull market. Investors have regained their confidence in the stock market and realized steady returns over this period. However, with such a long period of optimism, we are left wondering if the good times will come to an end and when a bear market will hit.

Should investors be worried? What do we do when a bear market hits?

Here two tips for investors to turn a bear market into an investing opportunity.

Control the controllables

A bear market is coming, but we don’t know when it will come or how bad it will be. Investors can struggle with this eventuality and can become consumed by the uncertainty. There is a lot of time and money spent on analysts trying to predict market outcomes and create certainty. Although they may be right from time to time, NOBODY can consistently forecast future markets.

How do we deal with the uncertainty? Accept it. Although we can’t control the future, we can control how we react when the bear market arrives. It’s critical that we don’t let our emotions get the best of us and that we maintain a long-term view. Markets are cyclical, and they will rise again and continue to grow over time. We just don’t know how long the bear market will last.

Don’t succumb to the market noise

When the bear market arrives, it will feel like Armageddon. The media will amplify the impact of the bear market, making investors feel like it will never rise again. Human emotion will take over, and investors may cash out at the most critical time in their investing journey. It’s at these times when the great investors are separated from the average.

So, the question is, “How do I become a great investor?”

Tune out the noise and keep putting your money into the market. When the markets are down, it’s the greatest opportunity for growth. Investors can acquire fantastic companies such as Royal Bank of Canada (TSX:RY)(NYSE:RY) and Fortis Inc. (TSX:FTS)(NYSE:FTS) at a significant discount. These companies will continue to generate profits regardless of these companies’ market value; therefore, it’s crucial that investors become greedy at these times.

Losses are only incurred when you sell off your investments, but if you stay the course and maintain a long-term view, you’ll be able to weather any financial storm and benefit from the greatest periods of growth.

Foolish bottom line

Here at the Fool, we embrace uncertainty and the unknown. While average investors panic and listen to the market noise, we take comfort in knowing that a bull market will come again and maintain a long-term view. By sticking to our investing strategy and continually putting money into great companies at a discount, we will be able to harness the power of compounding returns.

Don’t stop Foolin’!