Much of the world is still in shock after Donald Trump defied the odds and won the United States presidential election.

Investors had an opinion about Trump’s victory as well. It started out profoundly negative, as stock market futures crashed on Tuesday night after it looked likely he’d win. But not only were those losses erased by the end of trading Wednesday, but just about every stock was higher–in some cases, much higher.

Gains continued on Thursday with both the Dow Jones Industrial Average and S&P 500 each in positive territory in mid-day trading.

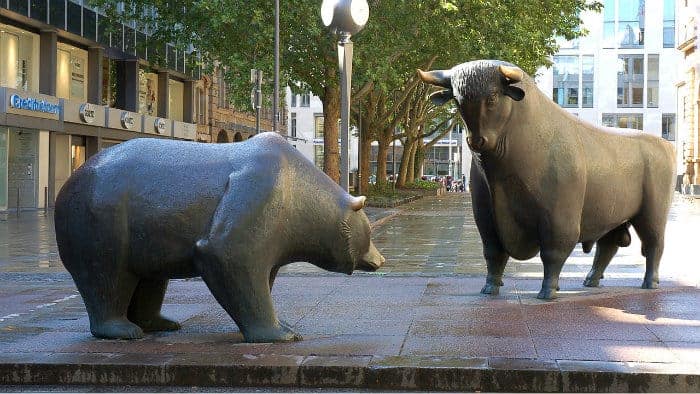

But many investors feel these gains could be just an illusion. They point at many of the anti-business policies Trump spoke about on the campaign trail–things like tariffs and pulling out of free-trade agreements. If he’s going to pass the kind of legislation needed to keep manufacturing jobs from moving overseas, a side effect could be scaring capital away from domestic investment.

Even Canadian investors have to worry about Trump. He said many times he’d try to renegotiate NAFTA or even leave the agreement completely. This could be bad news for Canadian manufacturers or even just Canadian companies with large U.S. divisions.

If you’re worried the initial enthusiasm about Trump’s victory will soon turn soundly bearish, hide out in these three names.

Bonds

If stocks go down, bonds tend to either hold their value or go up. It’s all about asset allocation.

The easiest way for Canadian investors to get bond exposure is the iShares DEX Universe Bond Index Fund (TSX:XBB). It holds more than 1,100 different government and corporate bonds with a market cap of $2.2 billion. It has plenty of liquidity for any retail investor, making it an ideal place to hide out over the short or medium term.

You’ll notice shares of that ETF trending sharply lower since Trump got elected, as investors fear the new president’s policies will be inflationary, which will ultimately lead to higher interest rates. That may happen, but I doubt it. And besides. A sharp move in that ETF is a decline of about 2%. Big deal.

Empire Company

When stocks melted down during the 2008-09 Great Recession, one sector actually went up as everything fell. That sector was Canada’s grocers.

Empire Company Limited (TSX:EMP.A) continues to be my favourite grocery stock. It’s far cheaper than peers on every metric, including price-to-book value, price-to-forward earnings, and price-to-sales.

It’s pretty obvious now that Empire paid too much to acquire Safeway in 2013, and the timing couldn’t have been worse. But those stores are still decent assets, and they will lead the way in growth once Alberta recovers.

In the meantime, investors are getting paid a 2.3% dividend to wait, which is an attractive payout for a sector not normally known for its dividends.

ATCO

ATCO Ltd. (TSX:ACO.X) is primarily a holding company. It owns approximately 53% of Canadian Utilities Limited, which in turn supplies electricity and natural gas to customers across Canada. ATCO also owns 75% of a structures and logistics division that supplies buildings and support to the construction sector. Canadian Utilities owns the other 25%.

ATCO is about as boring as it gets. It has a beta of 0.44 according to Google Finance, which means it’s only 44% as volatile as the market. It has also performed much better than Canadian Utilities in the past year, increasing 17.2% versus 4.8% on strength of the structures division. The company also pays a 2.6% yield.

The bottom line

If you’re nervous about a Trump presidency, it’s time to inject a little boring into your portfolio. And it doesn’t get much more boring than bonds, consumer staples, and a holding company that primarily owns a utility.