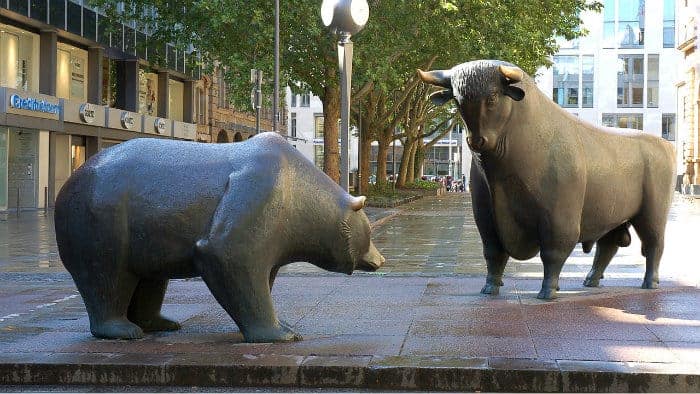

It must seem to be an odd time to be talking about a bear market—the S&P 500 recently hit all-time highs after climbing over 6% this year, and the TSX has followed the price of oil up to post 12% gains year-to-date (8% more upside would take the TSX to all-time highs).

While the TSX does not seem excessively expensive currently (the market-cap-to-GDP ratio is currently 119% compared with the historical mean of 118%), the nearly continuous 26% run-up in the market from the lows does put the market at risk of overvaluation at a time when global risks are mounting.

These risks have been well articulated recently by top-tier billionaire investors, including Prem Watsa, George Soros, and Stanley Druckenmiller, all of whom have short bets on the U.S. market (which correlates strongly to the Canadian market) or are investing in gold to protect against global growth risks stemming from an extremely overleveraged Chinese economy and a U.S. stock market that continues to reach new highs, despite quarter-over-quarter earnings growth trending downward steadily.

Regardless of your outlook on stocks, it pays to have to own “all weather” names, especially as valuations climbs, since higher valuations result in lower future returns.

Brookfield Infrastructure Partners LP

Brookfield Infrastructure Partners LP. (TSX:BIP.UN)(NYSE:BIP) invests in “real assets.” These include airports, pipelines, toll roads, ports, or communication infrastructure, and these assets are particularly valuable in today’s economic climate.

In a global environment characterized by low growth, low yields, and plenty of potential risks, infrastructure assets provide steady cash flows that are underpinned by either government regulation or long-term contracts. This provides stable, low-risk income with a low correlation to equity markets.

Brookfield provides global exposure to these low-risk assets, while also offering 6-9% organic earnings growth going forward via low-risk, built-in inflationary price increases, as well as through the execution of its $1.7 billion capital backlog. This growth does not include considerable upside that is available through M&A.

With a 4.7% dividend yield and dividend growth of 5-9% annually, Brookfield is sure to outperform during any type of market decline or recession due to its large base of income-focused shareholders and to the essential nature of its asset base.

Barrick Gold Corp.

Barrick Gold Corp. (TSX:ABX)(NYSE:ABX) is a smart way to gain exposure to the emerging rally in gold prices. There are several factors that move gold prices, and one of them is volatility. When volatility spikes, gold prices rise; market declines lead to spikes in volatility and therefore rallies in gold.

This will make gold a strong performer if some of the more bearish predictions for the U.S. equity market come to fruition. Most importantly, however, in an environment where interest rates are the lowest they’ve been in 5,000 years, and with over $11 trillion of negative-yielding debt (where bondholders need to pay the issuer to own the debt), it now pays to own gold, which has no yield.

These are the factors behind gold’s strong performance this year, and Barrick (the world’s largest gold producer) is an excellent way to play the trend. Barrick has been successfully executing a debt-reduction plan and is expecting to cut $2 billion in debt this year alone.

The debt-reduction plan will be successful since Barrick has budgeted for $1,100 per ounce gold prices compared to current prices of over $1,300 per ounce.

Vermilion Energy Inc.

It may seem odd to list an oil and natural gas producer like Vermilion Energy Inc. (TSX:VET)(NYSE:VET) on a list of defensive names, but Vermilion is truly unique in the energy space. Not only does Vermilion currently yield close to 6%, but it has never cut its dividend in its history (including during the recent oil rout).

This is due to Vermilion’s very strong free cash flow profile, which is supported by its best-in-class asset base (the highest netbacks in Canada) and its strong product portfolio diversification. Going forward, Vermilion’s stable and growing dividend will make it an attractive name, even in a bear market.